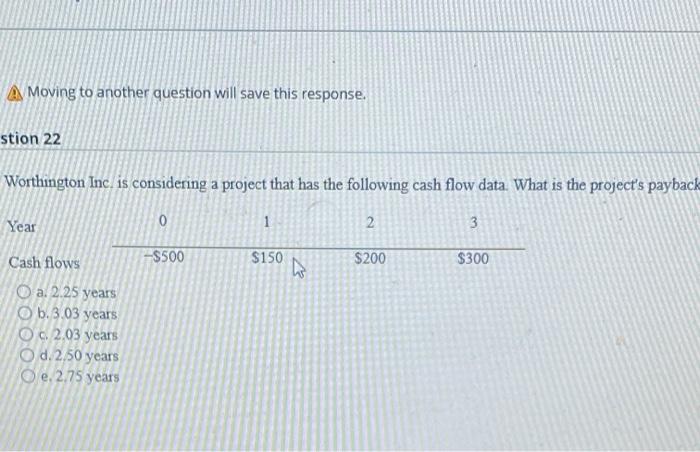

Question: A Moving to another question will save this response. stion 22 Worthington Inc. is considering a project that has the following cash flow data. What

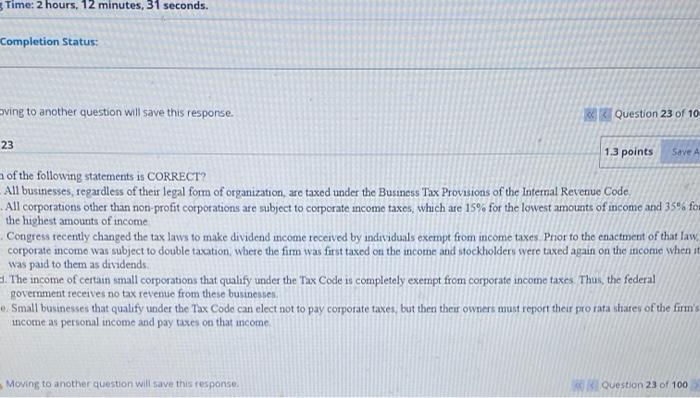

A Moving to another question will save this response. stion 22 Worthington Inc. is considering a project that has the following cash flow data. What is the project's payback 0 Year 1 2 2 3 Cash flows -$500 $150 $200 $300 ws O a. 2.25 years O b.3.03 years O c. 2.03 years O d.2,50 years Oe. 2.75 years Time: 2 hours, 12 minutes, 31 seconds. Completion Status: ving to another question will save this response. Question 23 of 10 23 Save A 1.3 points of the following statements is CORRECT? All businesses, regardless of their legal form of organization, are taxed under the Business Tax Provisions of the Internal Revenue Code All corporations other than non-profit corporations are subject to corporate income taxes, which are 15% for the lowest amounts of income and 35% for the highest amounts of income Congress recently changed the tax laws to make dividend income received by individuals exempt from income taxes Prior to the enactment of that law corporate income was subject to double taxation, where the firm was first taxed on the income and stockholders were taxed again on the mcome when it was paid to them as dividends d. The income of certain small corporations that qualify under the Tax Code is completely exempt from corporate income taxes. Thus, the federal government receives no tax revenue from these businesses Small businesses that qualify under the Tax Code can elect not to pay corporate taxes, but then their owners must report their pro rata shares of the firm's ancome as personal income and pay taxes on that income Moving to another question will save this response. Question 23 of 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts