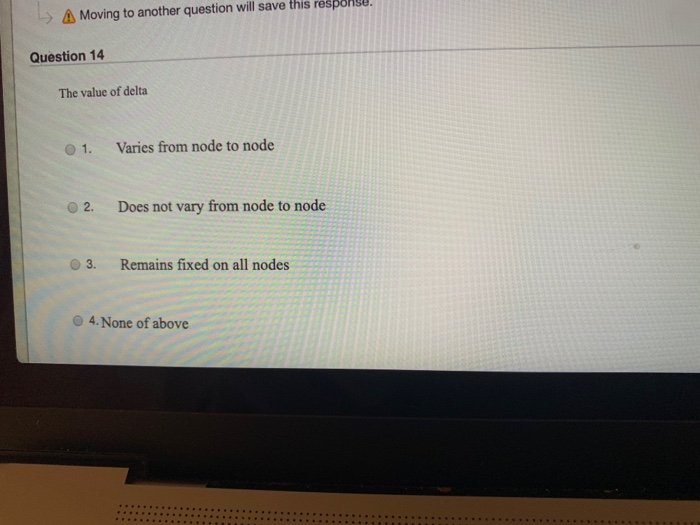

Question: > A Moving to another question will save this responsu. Question 14 The value of delta 1. Varies from node to node 2. Does not

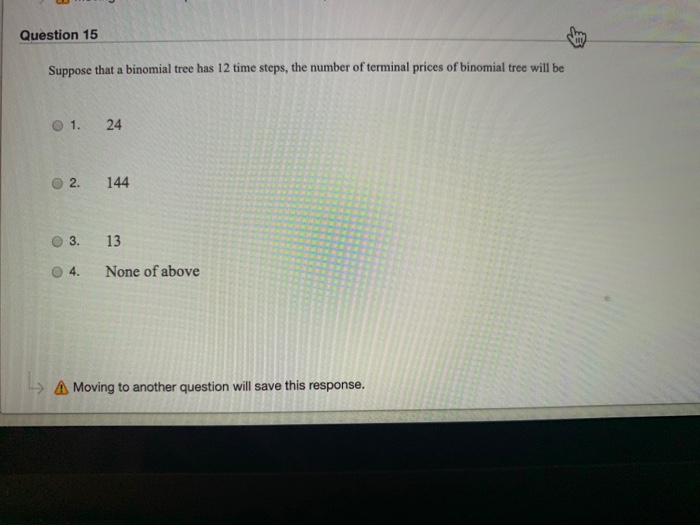

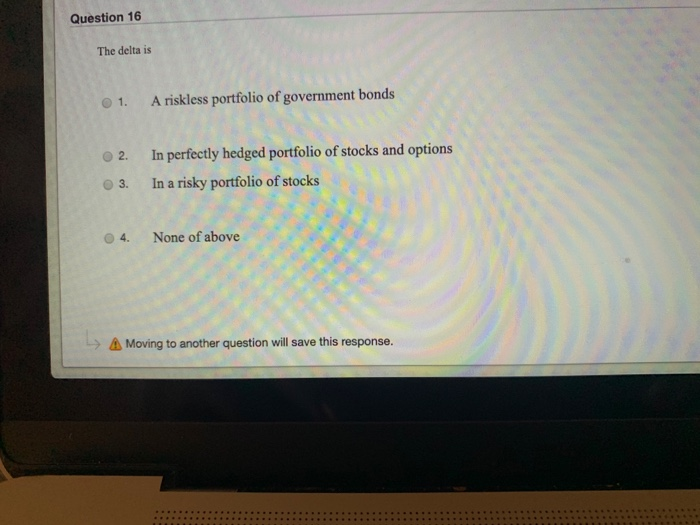

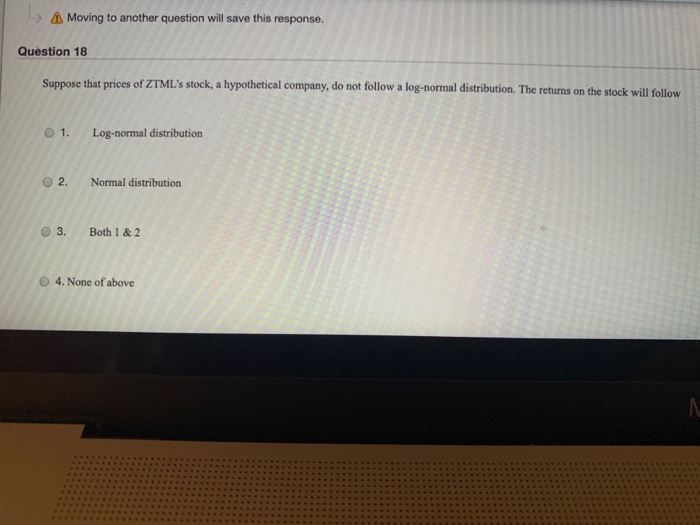

> A Moving to another question will save this responsu. Question 14 The value of delta 1. Varies from node to node 2. Does not vary from node to node 3. Remains fixed on all nodes 4. None of above Question 15 Suppose that a binomial tree has 12 time steps, the number of terminal prices of binomial tree will be 01. 24 2. 144 3. 13 4. None of above > Moving to another question will save this response. Question 16 The delta is 1. A riskless portfolio of government bonds 2. 3. In perfectly hedged portfolio of stocks and options In a risky portfolio of stocks 04. None of above 4. None of above Moving to another question will save this response. -> Moving to another question will save this response. Question 18 Suppose that prices of ZTML's stock, a hypothetical company, do not follow a log-normal distribution. The returns on the stock will follow 1. Log-normal distribution 2. Normal distribution 3. Both 1 & 2 4. None of above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts