Question: A Moving to the next question prevents changes to this answer. Question 22 of 50 > Question 22 1 points Save Answer Which ONE of

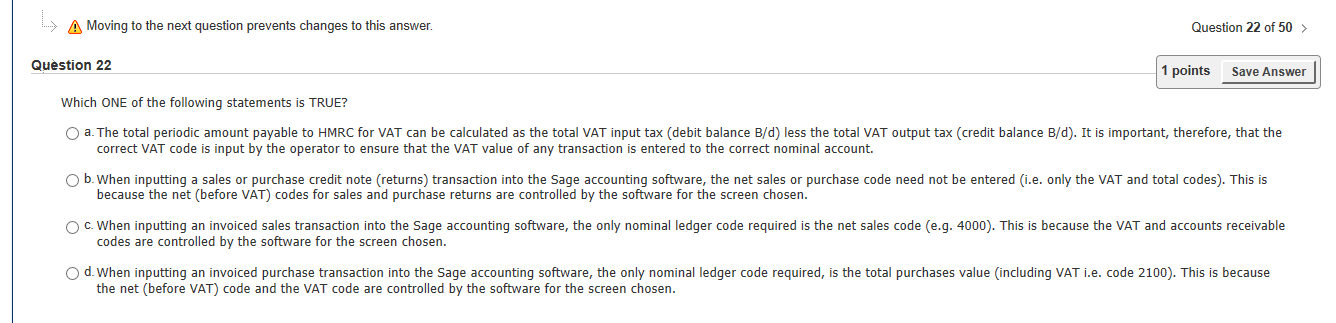

A Moving to the next question prevents changes to this answer. Question 22 of 50 > Question 22 1 points Save Answer Which ONE of the following statements is TRUE? O a. The total periodic amount payable to HMRC for VAT can be calculated as the total VAT input tax (debit balance B/d) less the total VAT output tax (credit balance B/d). It is important, therefore, that the correct VAT code is input by the operator to ensure that the VAT value of any transaction is entered to the correct nominal account. b. When inputting a sales or purchase credit note (returns) transaction into the Sage accounting software, the net sales or purchase code need not be entered (i.e. only the VAT and total codes). This is because the net (before VAT) codes for sales and purchase returns are controlled by the software for the screen chosen. c. When inputting an invoiced sales transaction into the Sage accounting software, the only nominal ledger code required is the net sales code (e.g. 4000). This is because the VAT and accounts receivable codes are controlled by the software for the screen chosen. d. When inputting an invoiced purchase transaction into the Sage accounting software, the only nominal ledger code required, is the total purchases value (including VAT i.e. code 2100). This is because the net (before VAT) code and the VAT code are controlled by the software for the screen chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts