Question: A Moving to the next question prevents changes to this answer. Question 1 of 2 Question 1 10 points Saved The M&N company is considering

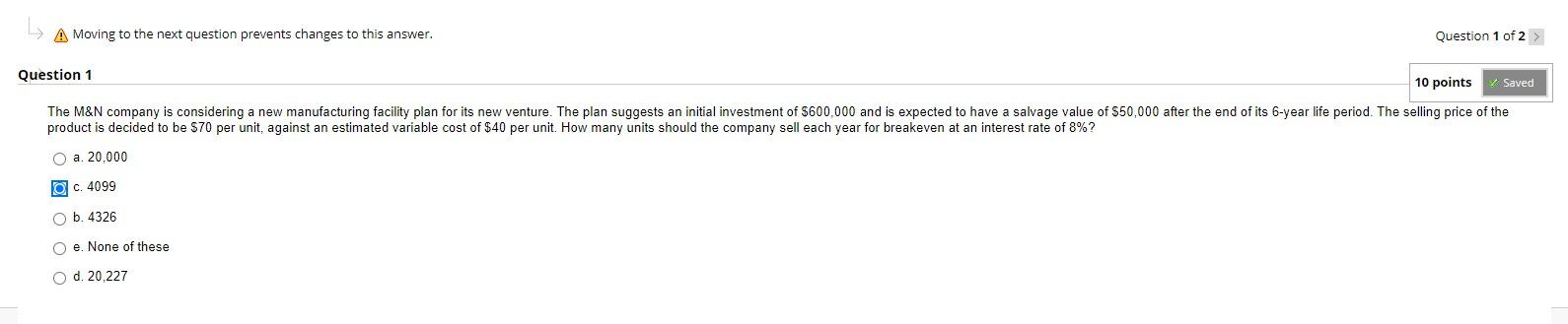

A Moving to the next question prevents changes to this answer. Question 1 of 2 Question 1 10 points Saved The M&N company is considering a new manufacturing facility plan for its new venture. The plan suggests an initial investment of $600,000 and is expected to have a salvage value of $50,000 after the end of its 6-year life period. The selling price of the product is decided to be $70 per unit, against an estimated variable cost of $40 per unit. How many units should the company sell each year for breakeven at an interest rate of 8%? O a. 20,000 OC. 4099 O b. 4326 Oe. None of these O d. 20,227

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts