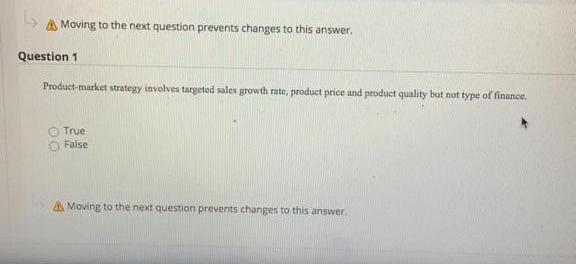

Question: (A) Moving to the next question prevents changes to this answer. uestion 1 Product-market itrategy involves targeted saler growth rate, product price ind product quality

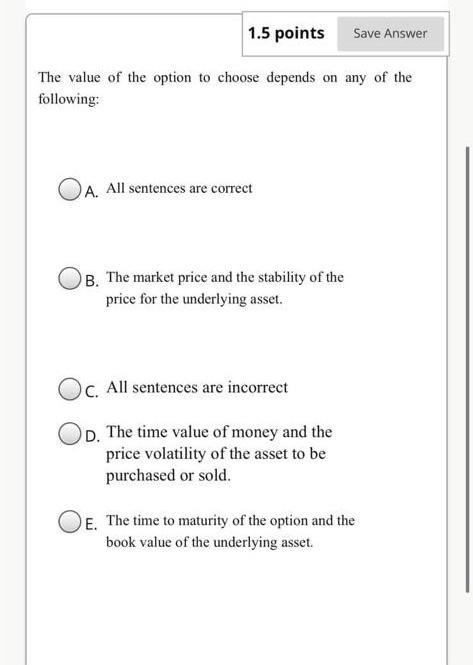

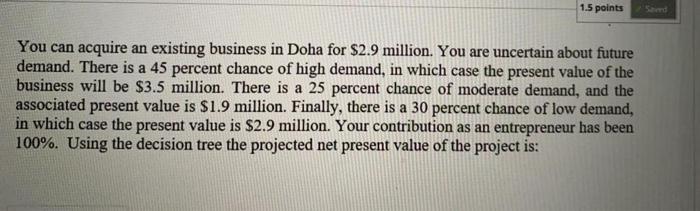

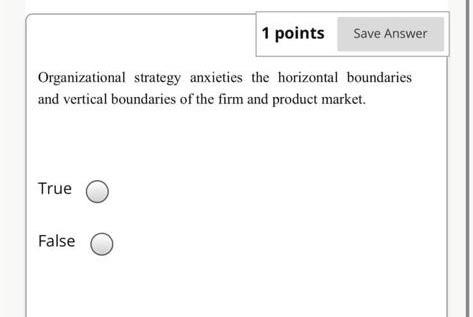

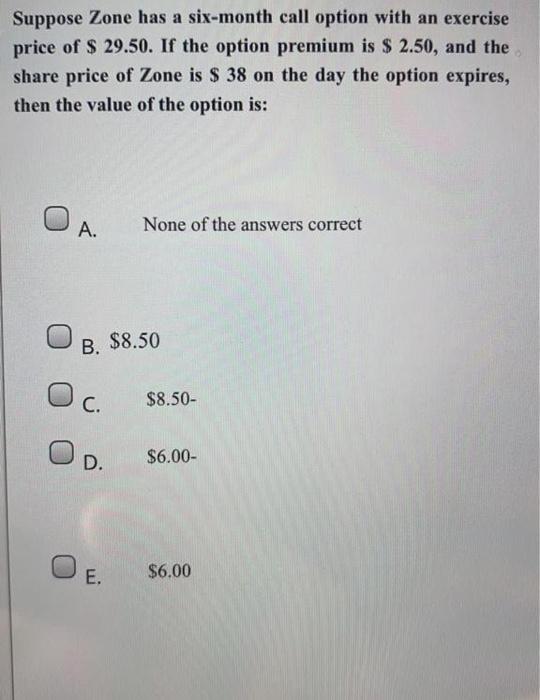

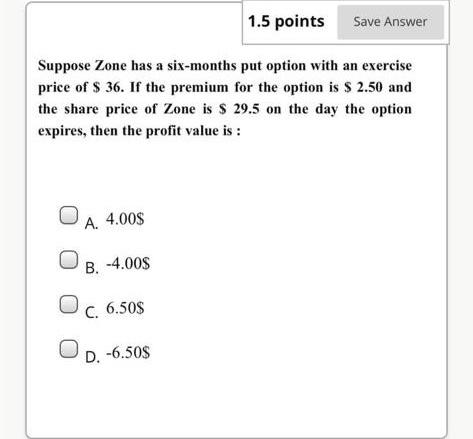

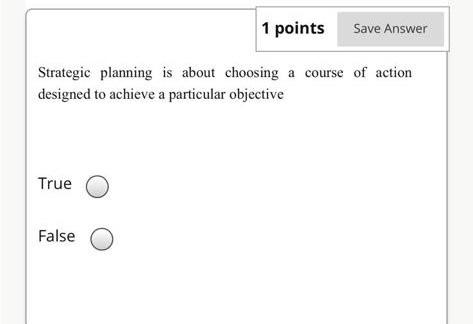

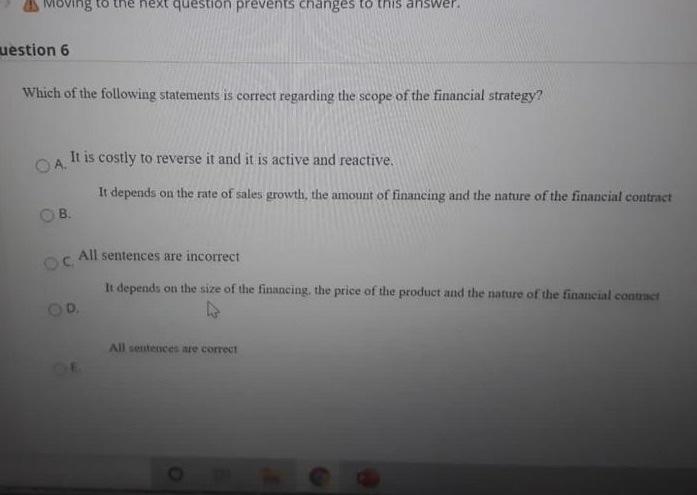

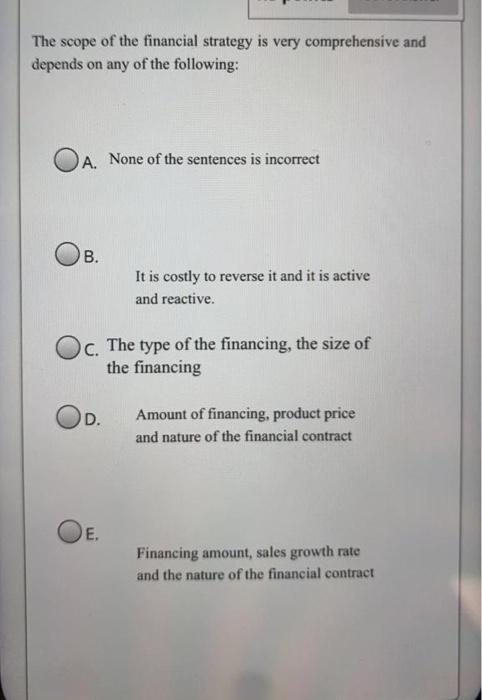

(A) Moving to the next question prevents changes to this answer. uestion 1 Product-market itrategy involves targeted saler growth rate, product price ind product quality but not type of finance. True False Moving to the next question prevents changes to this answer. The value of the option to choose depends on any of the following: A. All sentences are correct B. The market price and the stability of the price for the underlying asset. C. All sentences are incorrect D. The time value of money and the price volatility of the asset to be purchased or sold. E. The time to maturity of the option and the book value of the underlying asset. You can acquire an existing business in Doha for $2.9 million. You are uncertain about future demand. There is a 45 percent chance of high demand, in which case the present value of the business will be $3.5 million. There is a 25 percent chance of moderate demand, and the associated present value is $1.9 million. Finally, there is a 30 percent chance of low demand, in which case the present value is $2.9 million. Your contribution as an entrepreneur has been 100%. Using the decision tree the projected net present value of the project is: Organizational strategy anxieties the horizontal boundaries and vertical boundaries of the firm and product market. True False Suppose Zone has a six-month call option with an exercise price of $29.50. If the option premium is $2.50, and the share price of Zone is $38 on the day the option expires, then the value of the option is: A. None of the answers correct B. $8.50 C. $8.50 - D. $6.00 E. $6.00 Suppose Zone has a six-months put option with an exercise price of $36. If the premium for the option is $2.50 and the share price of Zone is $29.5 on the day the option expires, then the profit value is : A. 4.00$ B. 4.00$ C. 6.50S D. 6.50$ Strategic planning is about choosing a course of action designed to achieve a particular objective True False estion 6 Which of the following statements is correct regarding the scope of the financial strategy? It is costly to reverse it and it is active and reactive. It depends on the rate of sales growth, the amouut of financing and the nature of the financial contract B. All sentences are incorrect It depends on the size of the financing, the price of the product and the nature of the finmeial contact All seuteares are correct The scope of the financial strategy is very comprehensive and depends on any of the following: A. None of the sentences is incorrect B. It is costly to reverse it and it is active and reactive. C. The type of the financing, the size of the financing D. Amount of financing, product price and nature of the financial contract Financing amount, sales growth rate and the nature of the financial contract The plans of new ventures are constrained by prior decisions True False Moving to the next question prevents changes to this answer. (A) Moving to the next question prevents changes to this answer. uestion 1 Product-market itrategy involves targeted saler growth rate, product price ind product quality but not type of finance. True False Moving to the next question prevents changes to this answer. The value of the option to choose depends on any of the following: A. All sentences are correct B. The market price and the stability of the price for the underlying asset. C. All sentences are incorrect D. The time value of money and the price volatility of the asset to be purchased or sold. E. The time to maturity of the option and the book value of the underlying asset. You can acquire an existing business in Doha for $2.9 million. You are uncertain about future demand. There is a 45 percent chance of high demand, in which case the present value of the business will be $3.5 million. There is a 25 percent chance of moderate demand, and the associated present value is $1.9 million. Finally, there is a 30 percent chance of low demand, in which case the present value is $2.9 million. Your contribution as an entrepreneur has been 100%. Using the decision tree the projected net present value of the project is: Organizational strategy anxieties the horizontal boundaries and vertical boundaries of the firm and product market. True False Suppose Zone has a six-month call option with an exercise price of $29.50. If the option premium is $2.50, and the share price of Zone is $38 on the day the option expires, then the value of the option is: A. None of the answers correct B. $8.50 C. $8.50 - D. $6.00 E. $6.00 Suppose Zone has a six-months put option with an exercise price of $36. If the premium for the option is $2.50 and the share price of Zone is $29.5 on the day the option expires, then the profit value is : A. 4.00$ B. 4.00$ C. 6.50S D. 6.50$ Strategic planning is about choosing a course of action designed to achieve a particular objective True False estion 6 Which of the following statements is correct regarding the scope of the financial strategy? It is costly to reverse it and it is active and reactive. It depends on the rate of sales growth, the amouut of financing and the nature of the financial contract B. All sentences are incorrect It depends on the size of the financing, the price of the product and the nature of the finmeial contact All seuteares are correct The scope of the financial strategy is very comprehensive and depends on any of the following: A. None of the sentences is incorrect B. It is costly to reverse it and it is active and reactive. C. The type of the financing, the size of the financing D. Amount of financing, product price and nature of the financial contract Financing amount, sales growth rate and the nature of the financial contract The plans of new ventures are constrained by prior decisions True False Moving to the next question prevents changes to this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts