Question: A Moving to the next question prevents changes to this answer. Question 17 Over a sample period, an investor gathers the following data about three

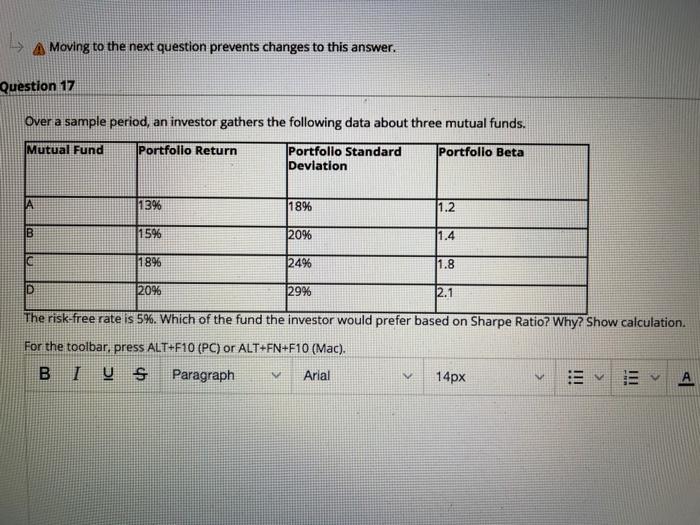

A Moving to the next question prevents changes to this answer. Question 17 Over a sample period, an investor gathers the following data about three mutual funds. Mutual Fund Portfolio Return Portfolio Beta Portfolio Standard Deviation 13% 18% 1.2 B 15% 20% 1.4 1896 124% 1.8 D 20% 129% 12.1 The risk-free rate is 5%. Which of the fund the investor would prefer based on Sharpe Ratio? Why? Show calculation. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI S Paragraph Arial 14px E V V A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock