Question: A Moving to the next question prevents changes to this answer. Question 7 Bonita Company had these transactions pertaining to stock investments: Feb. 1-Purchased 1

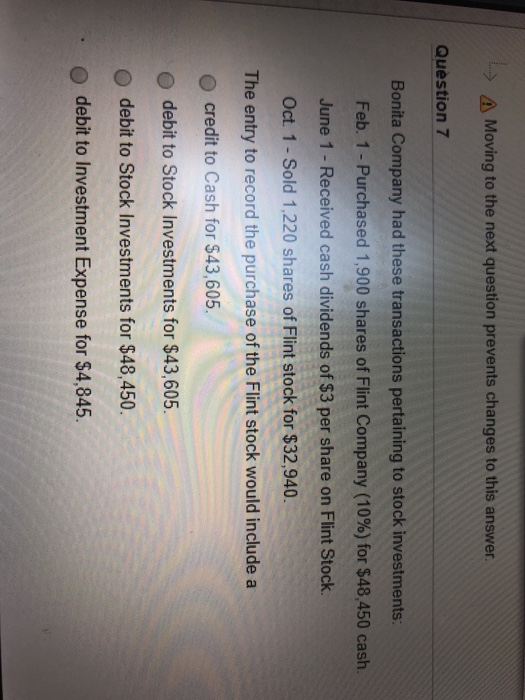

A Moving to the next question prevents changes to this answer. Question 7 Bonita Company had these transactions pertaining to stock investments: Feb. 1-Purchased 1 .900 shares of Flint Company (10%) for $48,450 cash. June 1- Received cash dividends of $3 per share on Flint Stock. Oct 1- Sold 1,220 shares of Flint stock for $32,940. The entry to record the purchase of the Flint stock would include a O credit to Cash for $43,605 O debit to Stock Investments for $43,605. O debit to Stock Investments for $48,450. O debit to Investment Expense for $4,845

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts