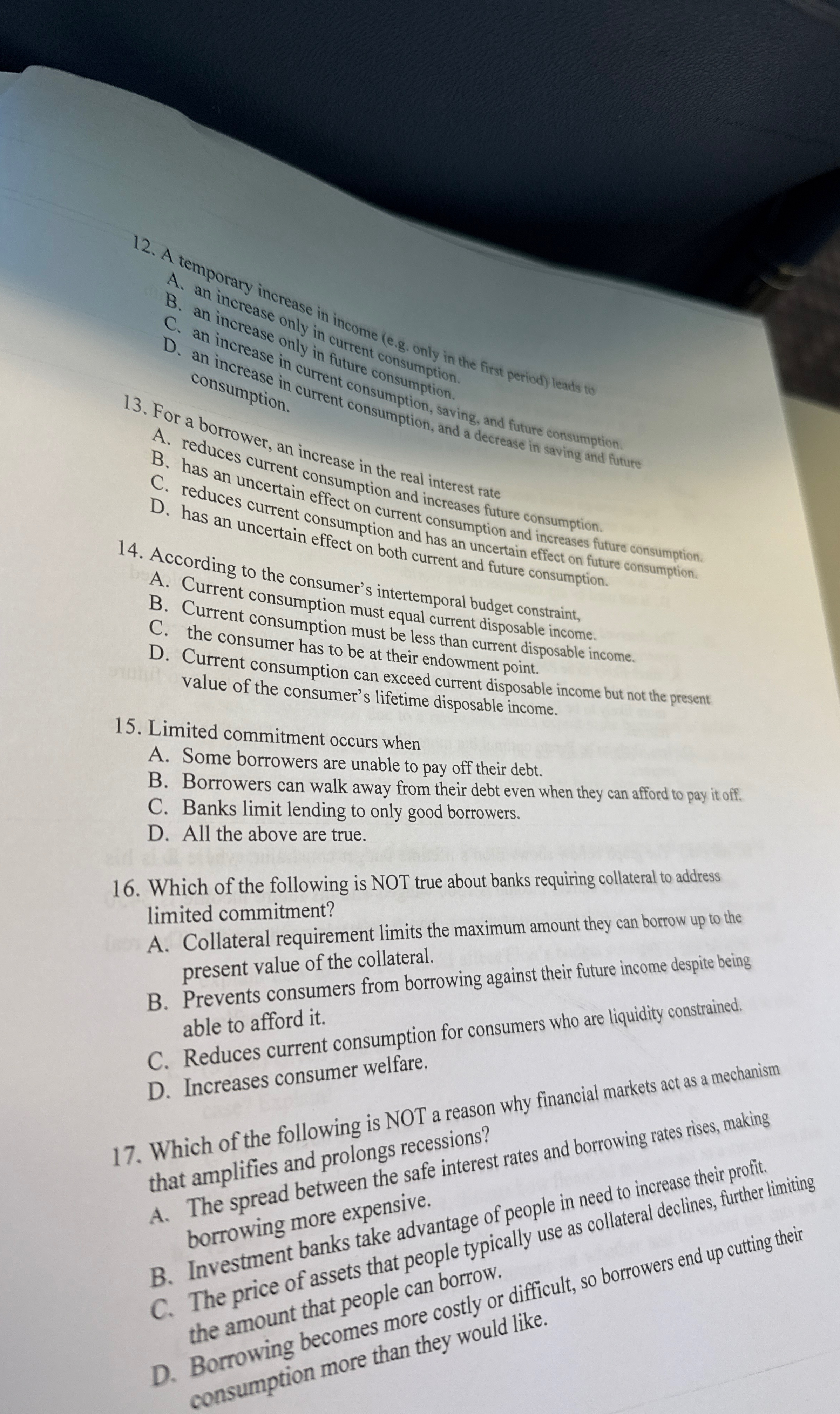

Question: A . mporary increase in income ( e . g . only in the first period ) leads to B . an increase only in

A "mporary increase in income eg only in the first period leads to

B an increase only in current consumption.

C an increase only in future consumption.

D an increase in current consumption, saving, and future consumption. consumption.

For a borrower, an increase in the real interest rate

A reduces current consumption and increases future consumption.

B has an uncertain effect on current consumption and increases future consumption.

C reduces current consumption and has an uncertain effect on future consumption.

D has an uncertain effect on both current and future consumption.

According to the consumer's intertemporal budget constraint,

A Current consumption must equal current disposable income.

B Current consumption must be less than current disposable income.

C the consumer has to be at their endowment point.

D Current consumption can exceed current disposable income but not the present value of the consumer's lifetime disposable income.

Limited commitment occurs when

A Some borrowers are unable to pay off their debt.

B Borrowers can walk away from their debt even when they can afford to pay it off.

C Banks limit lending to only good borrowers.

D All the above are true.

Which of the following is NOT true about banks requiring collateral to address limited commitment?

A Collateral requirement limits the maximum amount they can borrow up to the present value of the collateral.

B Prevents consumers from borrowing against their future income despite being able to afford it

C Reduces current consumption for consumers who are liquidity constrained.

D Increases consumer welfare.

Which of the following is NOT a reason why financial markets act as a mechanism that amplifies and prolongs recessions?

A The spread between the safe interest rates and borrowing rates rises, making borrowing more expensive.

B Investment banks take advantage of people in need to increase their profit. the amount that people can borrow.

D Borrowing becomes more costly or difficult, so borrowers end up cuting their

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock