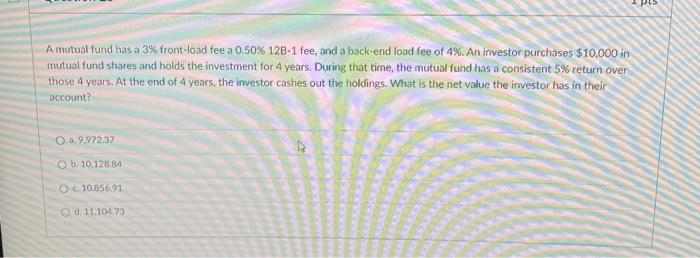

Question: A mutual fund has a 3% front-load fee a 0.50% 128-1 fee, and a back-end load fee of 4%. An investor purchases $10,000 in mutual

A mutual fund has a 3% front-load fee a 0.50% 128-1 fee, and a back-end load fee of 4%. An investor purchases $10,000 in mutual fund shares and holds the investment for 4 years. During that time, the mutual fund has a consistent 5% return over those 4 years. At the end of 4 years, the investor cashes out the holdings. What is the net value the investor has in their account? O 997237 b. 10.128.84 O 10,856.91 O d. 11.104.73

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts