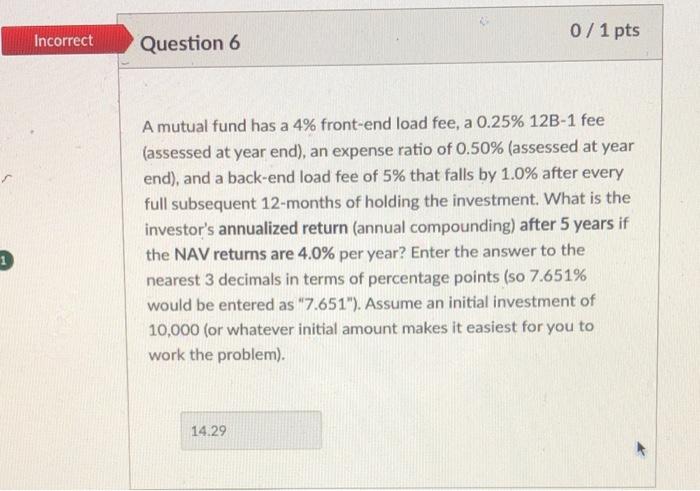

Question: A mutual fund has a 4% front-end load fee, a 0.25%12B1 fee (assessed at year end), an expense ratio of 0.50% (assessed at year end),

A mutual fund has a 4% front-end load fee, a 0.25%12B1 fee (assessed at year end), an expense ratio of 0.50% (assessed at year end), and a back-end load fee of 5% that falls by 1.0% after every full subsequent 12-months of holding the investment. What is the investor's annualized return (annual compounding) after 5 years if the NAV returns are 4.0% per year? Enter the answer to the nearest 3 decimals in terms of percentage points (so 7.651% would be entered as " 7.651 "). Assume an initial investment of 10,000 (or whatever initial amount makes it easiest for you to work the problem)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts