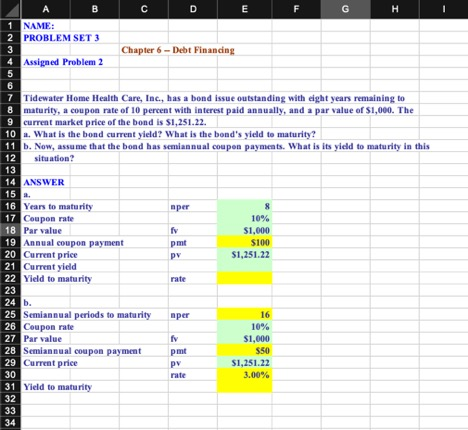

Question: A NAME: PROBLEM SET 3 Chapter 6-Debt Financing Assigned Problem 2 7 Tidewater Home Health Care, Inc., has a bond issue outstanding with eight years

A NAME: PROBLEM SET 3 Chapter 6-Debt Financing Assigned Problem 2 7 Tidewater Home Health Care, Inc., has a bond issue outstanding with eight years remaining to 8 maturity, a coupon rate of 10 percent with interest paid annually, and a par value of $1,000. The 9 current market price of the bond is $1,251.22. 10. What is the bond current yield? What is the bond's yield to maturity? 11 . Now, assume that the bond has semiannual coupon payments. What is its yield to maturity in this 12 situation? 13 14 ANSWER 15 - aper 16 Years to maturity 17 Coupon rate 18 Par value 19 Annual coupon payment 20 Current price 21 Current yield 22 Yield to maturity 10% $1.000 $100 $1.251.22 put PY rate per 16 24 b. 25 Semiannual periods to maturity 26 Coupon rate 27 Par value 28 Semiannual coupon payment 29 Current price pe 10% $1.000 $50 $1.251.22 3.00% pv rate 31 Yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts