Question: A. negative B. positive C. indistinguishable from zero please provide an explanation along with the answer, thanks! deals in 70 functional currencies other than the

A. negative

B. positive

C. indistinguishable from zero

please provide an explanation along with the answer, thanks!

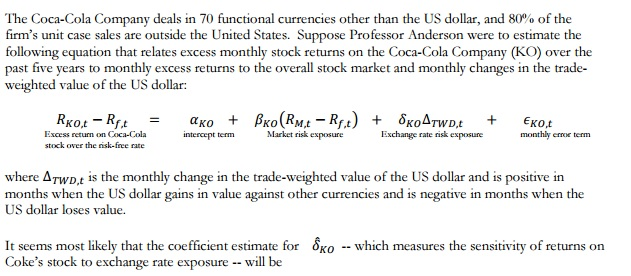

deals in 70 functional currencies other than the US dollar, and 80% of the The Coca-Cola Company deals in 70 firm's unit case sales are outside the United States. Suppose Professor Anderson were to estimate the following equation that relates excess monthly stock returns on the Coca-Cola Company (KO) over the past five years to monthly excess returns to the overall stock market and monthly changes in the trade- weighted value of the US dollar: = + EKot Ko.t ft Excess return on Coca-Cola stock over the risk-free rate f,t ntercept term Market risk exposure Exchange rate risk exposure monthly ermoe term where TWD,t is the monthly change in the trade-weighted value of the US dollar and is positive in months when the US dollar gains in value against ot US dollar loses value. currencies and is is negative in months when the - which measures the sensitivity of returns on Coke's stock to exchange rate exposure - - will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts