Question: a. Nelson's Landscaping Services just completed a pro forma statement using the percentage of sales approach. The pro forma has a projected external financing need

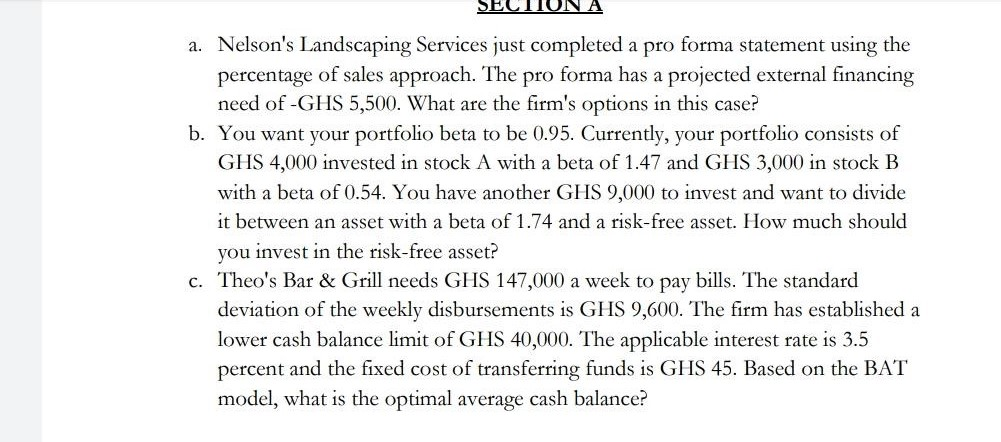

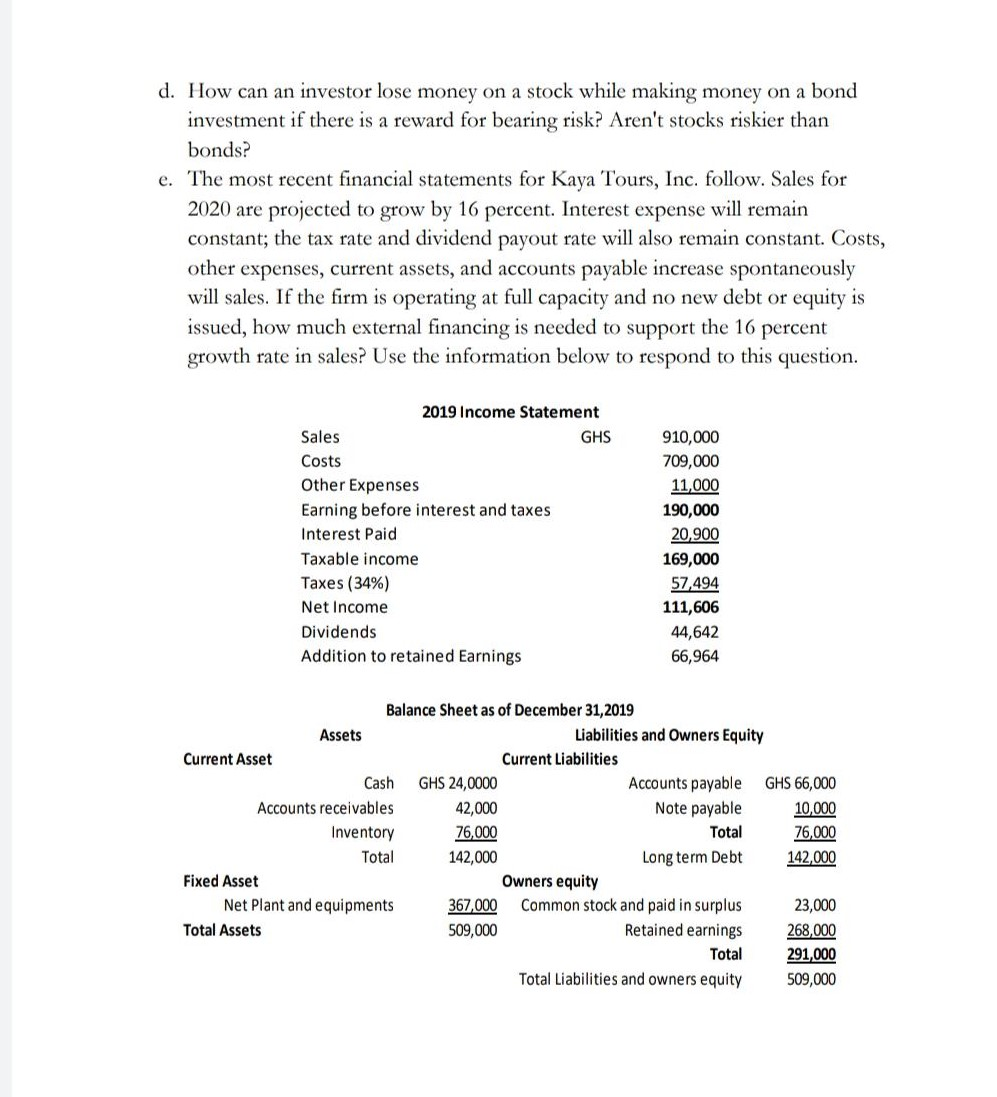

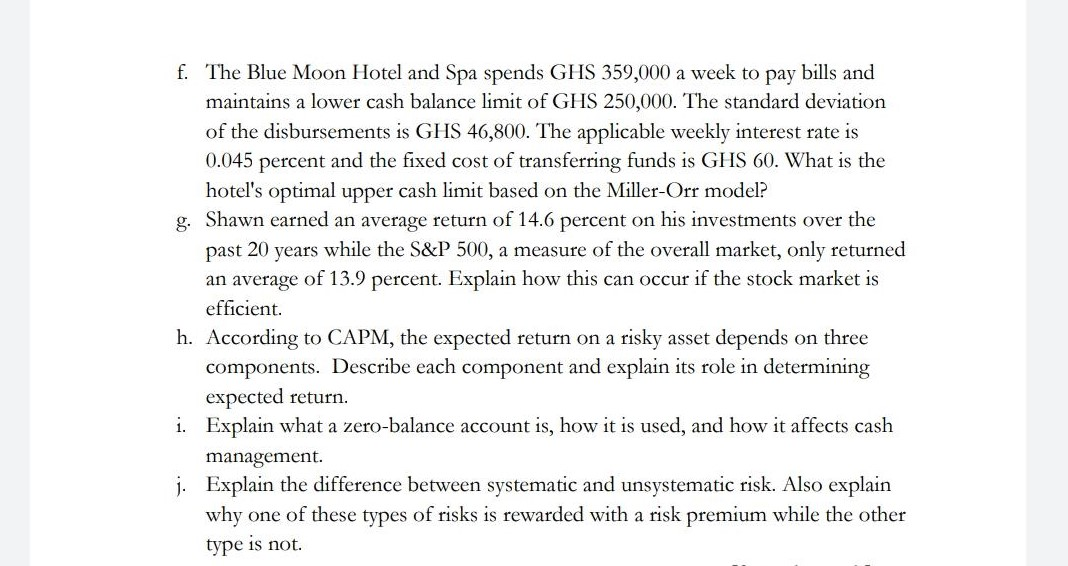

a. Nelson's Landscaping Services just completed a pro forma statement using the percentage of sales approach. The pro forma has a projected external financing need of -GHS 5,500. What are the firm's options in this case? b. You want your portfolio beta to be 0.95. Currently, your portfolio consists of GHS 4,000 invested in stock A with a beta of 1.47 and GHS 3,000 in stock B with a beta of 0.54. You have another GHS 9,000 to invest and want to divide it between an asset with a beta of 1.74 and a risk-free asset. How much should you invest in the risk-free asset? c. Theo's Bar & Grill needs GHS 147,000 a week to pay bills. The standard deviation of the weekly disbursements is GHS 9,600. The firm has established a lower cash balance limit of GHS 40,000. The applicable interest rate is 3.5 percent and the fixed cost of transferring funds is GHS 45. Based on the BAT model, what is the optimal average cash balance? d. How can an investor lose money on a stock while making money on a bond investment if there is a reward for bearing risk? Aren't stocks riskier than bonds? e. The most recent financial statements for Kaya Tours, Inc. follow. Sales for 2020 are projected to grow by 16 percent. Interest expense will remain constant; the tax rate and dividend payout rate will also remain constant. Costs, other expenses, current assets, and accounts payable increase spontaneously will sales. If the firm is operating at full capacity and no new debt or equity is issued, how much external financing is needed to support the 16 percent growth rate in sales? Use the information below to respond to this question. 2019 Income Statement Sales GHS Costs Other Expenses Earning before interest and taxes Interest Paid Taxable income Taxes (34%) Net Income Dividends Addition to retained Earnings 910,000 709,000 11,000 190,000 20,900 169,000 57,494 111,606 44,642 66,964 Balance Sheet as of December 31, 2019 Assets Liabilities and Owners Equity Current Asset Current Liabilities Cash GHS 24,0000 Accounts payable GHS 66,000 Accounts receivables 42,000 Note payable 10,000 Inventory 76,000 Total 76,000 Total 142,000 Long term Debt 142,000 Fixed Asset Owners equity Net Plant and equipments 367,000 Common stock and paid in surplus 23,000 Total Assets 509,000 Retained earnings 268,000 Total 291,000 Total Liabilities and owners equity 509,000 f. The Blue Moon Hotel and Spa spends GHS 359,000 a week to pay bills and maintains a lower cash balance limit of GHS 250,000. The standard deviation of the disbursements is GHS 46,800. The applicable weekly interest rate is 0.045 percent and the fixed cost of transferring funds is GHS 60. What is the hotel's optimal upper cash limit based on the Miller-Orr model? g. Shawn earned an average return of 14.6 percent on his investments over the past 20 years while the S&P 500, a measure of the overall market, only returned an average of 13.9 percent. Explain how this can occur if the stock market is efficient. h. According to CAPM, the expected return on a risky asset depends on three components. Describe each component and explain its role in determining expected return. i. Explain what a zero-balance account is, how it is used, and how it affects cash management. j. Explain the difference between systematic and unsystematic risk. Also explain why one of these types of risks is rewarded with a risk premium while the other type is not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts