Question: a . Net income was $ 3 5 , 0 0 0 . b . Issued common stock for $ 6 4 , 0 0

a Net income was $

b Issued common stock for $ cash.

c Paid cash dividend of $

d Paid $ cash to settle a longterm notes payable at its $ maturity value.

e Paid $ cash to acquire its treasury stock.

f Purchased equipment for $ cash.

Use the above information to determine cash flows from financing activities.

Note: Amounts to be deducted should be indicated with a minus sign.

tableStatement of Cash Flows partialCash flows from financing activities,

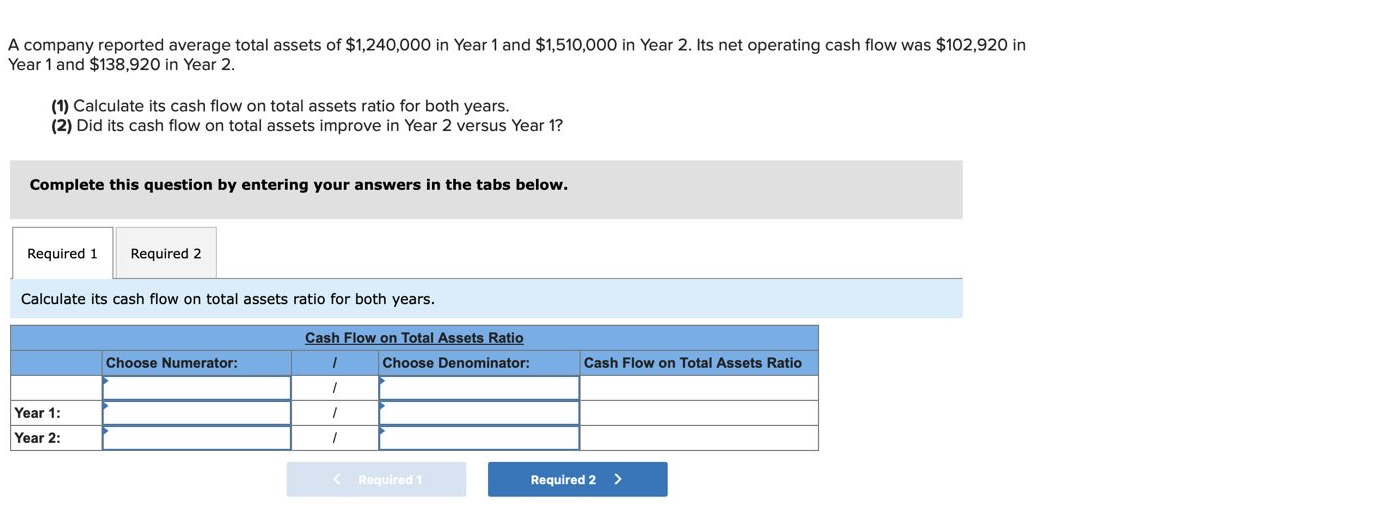

A company reported average total assets of $ in Year and $ in Year Its net operating cash flow was $ in Year and $ in Year

Calculate its cash flow on total assets ratio for both years.

Did its cash flow on total assets improve in Year versus Year

Complete this question by entering your answers in the tabs below.

Calculate its cash flow on total assets ratio for both years.

tableCash Flow on Total Assets Ratio,Choose Numerator:,Choose Denominator:,Cash Flow on Total Assets RatioYear :Year :

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock