Question: a) Net working capital increases when inventory is purchased with cash b) Net working capital excludes inventory c) Total assets must increase if net working

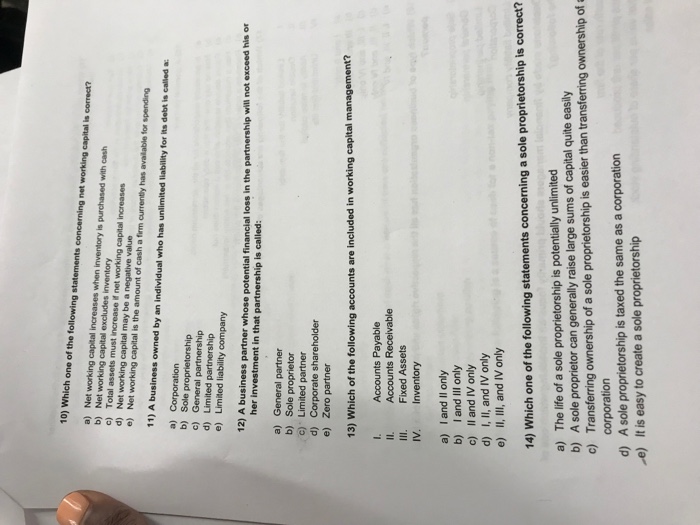

a) Net working capital increases when inventory is purchased with cash b) Net working capital excludes inventory c) Total assets must increase if net working capital increases d) Net working capital may be a negative value e) Net working capital is the amount of cash a firm currently has available for spending 11) A business owned by an individual who has unlimited liability for its debt is called a b) Sole proprietorship c) General partnership d) Limited partnership e) Limited liability company 12) A business partner whose potential financial loss in the partnership will not exceed his or her investment in that partnership is called: a) General partner b) Sole proprietor c) Limited partner e) Zero partner 13) Which of the following accounts are included in working capital management? I Accounts Payable II. Accounts Receivable IlI. Fixed Assets IV. Inventory a) Iand Il only b) l and only c) 11 and only d) 1,11, and IV only e) II, II, and IV only 14) Which one of the following statements concerning a sole proprietorship is correct? a) The life of a sole proprietorship is potentially unlimited b) A sole proprietor can generally raise large sums of capital quite easily c) Transferring ownership of a sole proprietorship is easier than transferring ownership of corporation d) A sole proprietorship is taxed the same as a corporation e) It is easy to create a sole proprietorship

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts