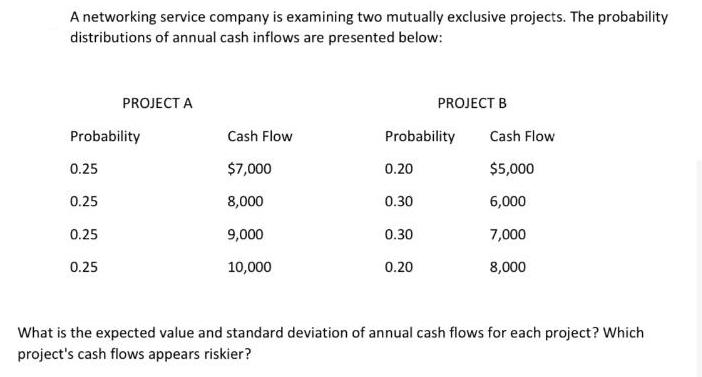

Question: A networking service company is examining two mutually exclusive projects. The probability distributions of annual cash inflows are presented below: Probability 0.25 0.25 PROJECT

A networking service company is examining two mutually exclusive projects. The probability distributions of annual cash inflows are presented below: Probability 0.25 0.25 PROJECT A 0.25 0.25 Cash Flow $7,000 8,000 9,000 10,000 Probability 0.20 0.30 0.30 PROJECT B 0.20 Cash Flow $5,000 6,000 7,000 8,000 What is the expected value and standard deviation of annual cash flows for each project? Which project's cash flows appears riskier?

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

SOLUTION To calculate the expected value and standard deviation of annual cash flows for each projec... View full answer

Get step-by-step solutions from verified subject matter experts