Question: A new firm is developing its business plan. It will require $565,000 of assets, and it projects $452,800 of sales and $354,300 of operating costs

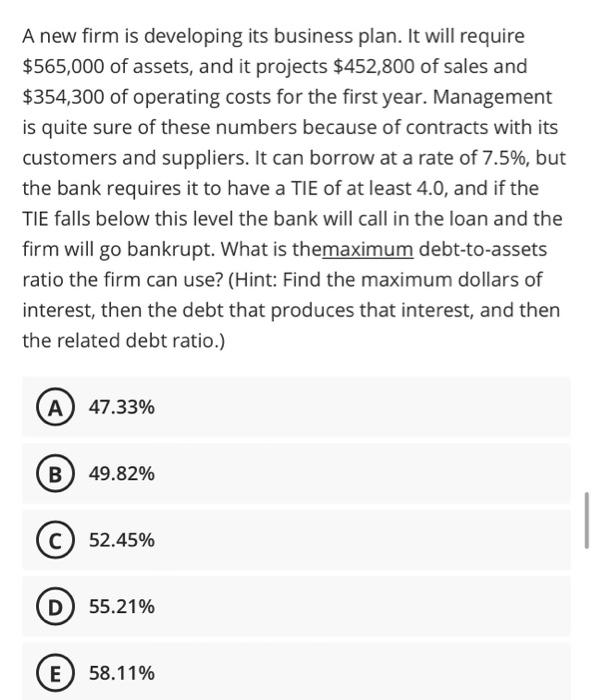

A new firm is developing its business plan. It will require $565,000 of assets, and it projects $452,800 of sales and $354,300 of operating costs for the first year. Management is quite sure of these numbers because of contracts with its customers and suppliers. It can borrow at a rate of 7.5%, but the bank requires it to have a TIE of at least 4.0 , and if the TIE falls below this level the bank will call in the loan and the firm will go bankrupt. What is themaximum debt-to-assets ratio the firm can use? (Hint: Find the maximum dollars of interest, then the debt that produces that interest, and then the related debt ratio.) 47.33% B 49.82% (C) 52.45% (D) 55.21% 58.11%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts