Question: A new project will require an increase in operating current assets of $15,000, and an increase in operating current liabilities of $12,000. It is assumed

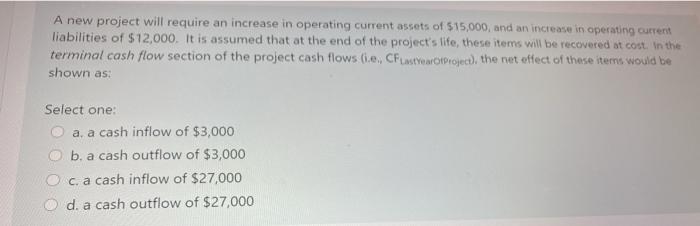

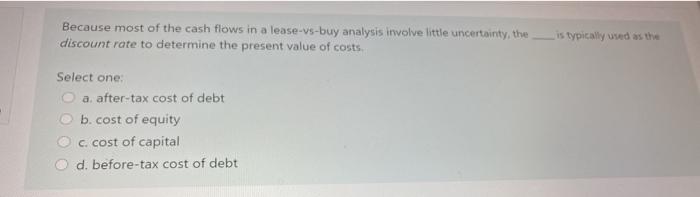

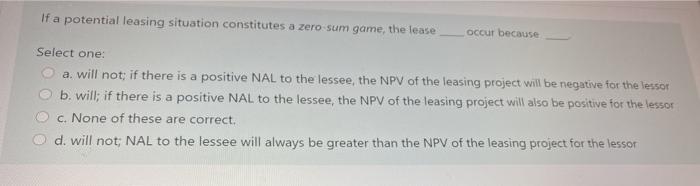

A new project will require an increase in operating current assets of $15,000, and an increase in operating current liabilities of $12,000. It is assumed that at the end of the project's life, these items will be recovered at cost. In the terminal cash flow section of the project cash flows (ie, ChusterProject), the net effect of these items would be shown as: Select one: a, a cash inflow of $3,000 b. a cash outflow of $3,000 c. a cash inflow of $27,000 d. a cash outflow of $27,000 Because most of the cash flows in a lease-vs-buy analysis involve little uncertainty, the discount rate to determine the present value of costs is typically used as the Select one: a. after-tax cost of debt b. cost of equity c. cost of capital d. before-tax cost of debt If a potential leasing situation constitutes a zero sum game, the lease occur because Select one: a. will not; if there is a positive NAL to the lessee, the NPV of the leasing project will be negative for the lesson b. will; if there is a positive NAL to the lessee, the NPV of the leasing project will also be positive for the lesson c. None of these are correct. d. will not; NAL to the lessee will always be greater than the NPV of the leasing project for the lesson

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts