Question: A new property development is expected to produce a first year NOI of $100,000.00 which is expected to grow by an annual rate of 2%

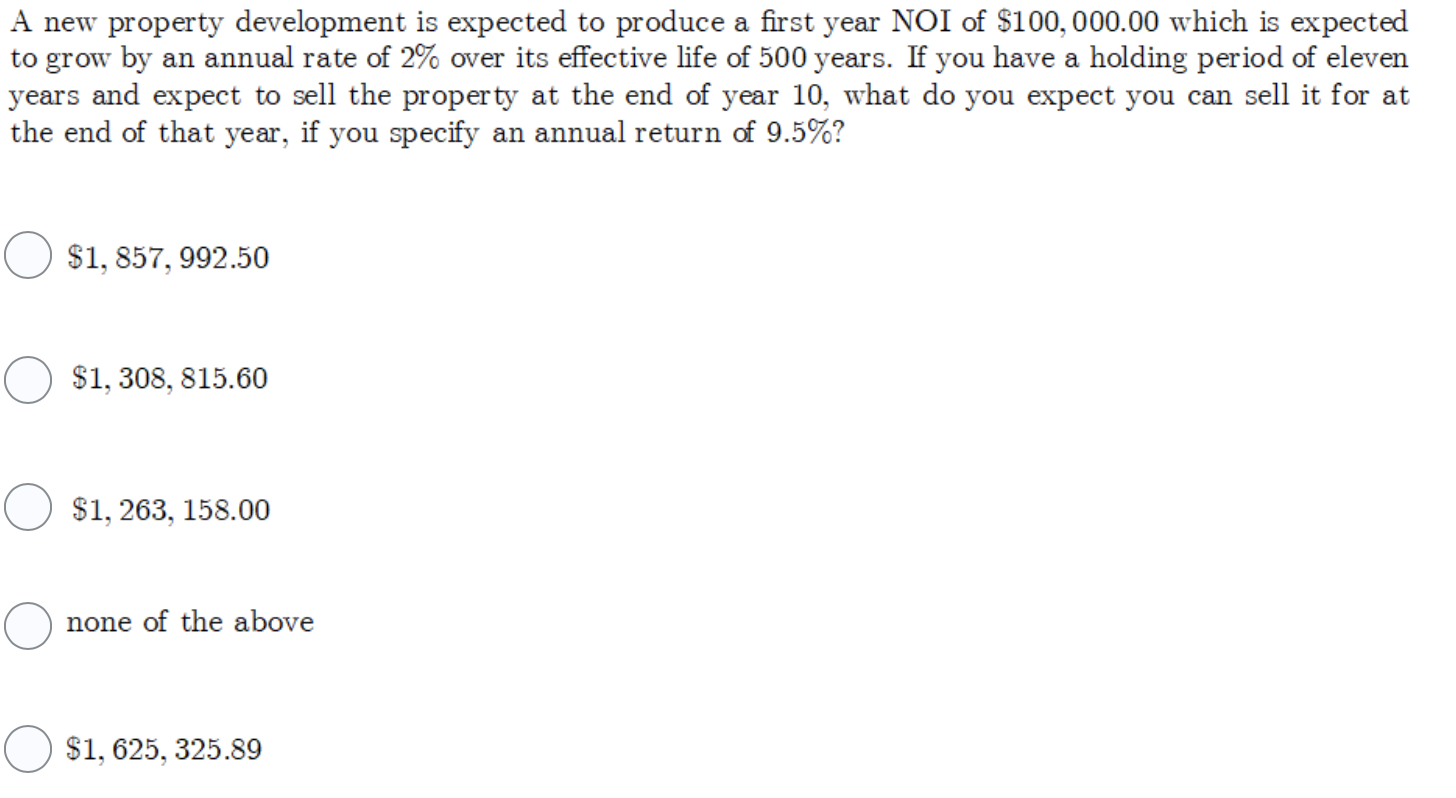

A new property development is expected to produce a first year NOI of $100,000.00 which is expected to grow by an annual rate of 2% over its effective life of 500 years. If you have a holding period of eleven years and expect to sell the property at the end of year 10, what do you expect you can sell it for at the end of that year, if you specify an annual return of 9.5%? $1,857, 992.50 $1,308, 815.60 $1, 263, 158.00 none of the above $1,625, 325.89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts