Question: A new tech stock is expected to pay a dividend of $1.00 per share next year (D1). Dividends will grow rapidly at 20% per year

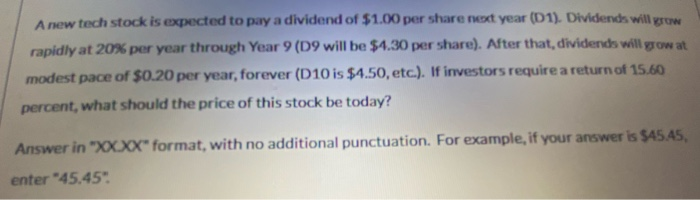

A new tech stock is expected to pay a dividend of $1.00 per share next year (D1). Dividends will grow rapidly at 20% per year through Year 9 (D9 will be $4.30 per share). After that, dividends will now! modest pace of $0.20 per year, forever (D10 is $4.50, etc.). If investors require a return of 15.60 percent, what should the price of this stock be today? Answer in "XX.XX" format, with no additional punctuation. For example, if your answer is 54545, enter "45.45" A new tech stock is expected to pay a dividend of $1.00 per share next year (D1). Dividends will grow rapidly at 20% per year through Year 9 (D9 will be $4.30 per share). After that, dividends will now! modest pace of $0.20 per year, forever (D10 is $4.50, etc.). If investors require a return of 15.60 percent, what should the price of this stock be today? Answer in "XX.XX" format, with no additional punctuation. For example, if your answer is 54545, enter "45.45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts