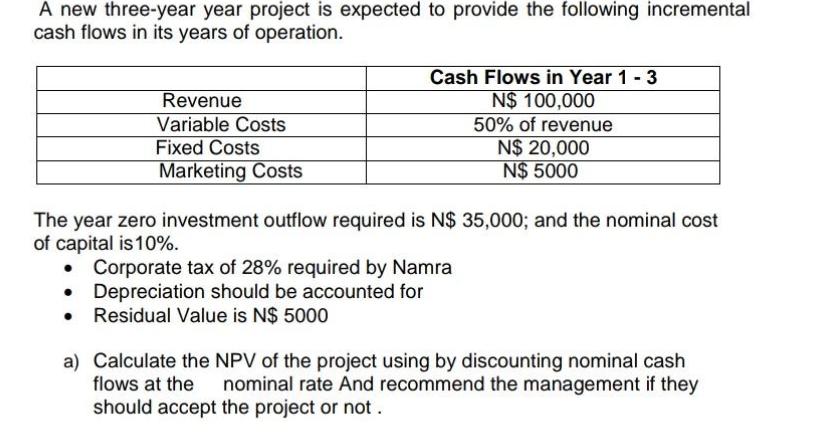

Question: A new three-year year project is expected to provide the following incremental cash flows in its years of operation. Revenue Variable Costs Fixed Costs

A new three-year year project is expected to provide the following incremental cash flows in its years of operation. Revenue Variable Costs Fixed Costs Marketing Costs Cash Flows in Year 1 - 3 N$ 100,000 50% of revenue The year zero investment outflow required is N$ 35,000; and the nominal cost of capital is 10%. N$ 20,000 N$ 5000 Corporate tax of 28% required by Namra Depreciation should be accounted for Residual Value is N$ 5000 a) Calculate the NPV of the project using by discounting nominal cash flows at the nominal rate And recommend the management if they should accept the project or not.

Step by Step Solution

3.29 Rating (143 Votes )

There are 3 Steps involved in it

To calculate the net present value NPV of the project we need to discount the incremental cash flows at the nominal rate The NPV is obtained by subtra... View full answer

Get step-by-step solutions from verified subject matter experts