Question: a. Notes Receivable is a 3-months, 6% note accepted on November 1, 2014. b. Long Term Notes Payable is a 5-year. 5% note, that was

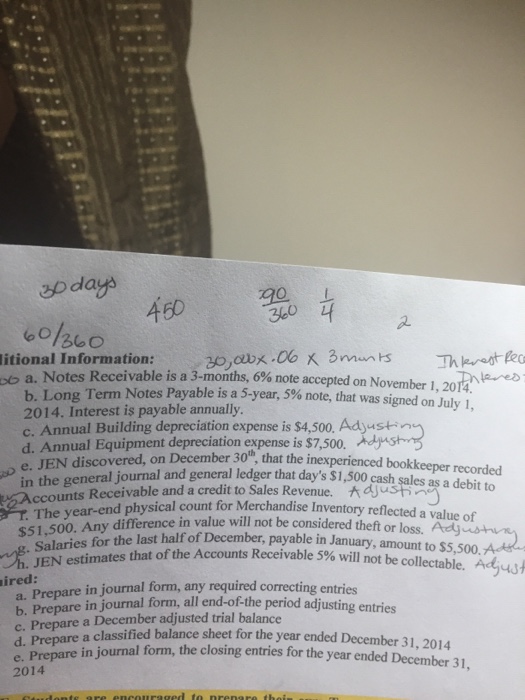

a. Notes Receivable is a 3-months, 6% note accepted on November 1, 2014. b. Long Term Notes Payable is a 5-year. 5% note, that was signed on July 1, 2014. Interest is payable annually. c. Annual Building depredation expense is $4,500. d. Annual Equipment depreciation expense is $7,500. e. JEN discovered, on December 30th, that the in experienced bookkeepers recorded in the general journal and general ledger that day's $1,500 cash Sales as a debit accounts Receivable and a credit to Sales Revenue. 3 .The year-end physical count for Merchandise Inventory reflected a value of $51,500. 1/4. Any difference in value will not be considered theft or loss. g. Salaries for the last half of December, payable in January, amount to $5,500 JEN estimates that of the Accounts Receivable S% will not be collectable..3 red: a. Prepare in journal form, any required correcting entries h. prepare in Journal form, all end-of-the period adjusting entries c. prepare a December adjusted trial balance d. prepare a classified balance sheet for the year ended December 31, 2014 e. prepare in journal form, the closing entries for the year ended December 31, 2014 a. Notes Receivable is a 3-months, 6% note accepted on November 1, 2014. b. Long Term Notes Payable is a 5-year. 5% note, that was signed on July 1, 2014. Interest is payable annually. c. Annual Building depredation expense is $4,500. d. Annual Equipment depreciation expense is $7,500. e. JEN discovered, on December 30th, that the in experienced bookkeepers recorded in the general journal and general ledger that day's $1,500 cash Sales as a debit accounts Receivable and a credit to Sales Revenue. 3 .The year-end physical count for Merchandise Inventory reflected a value of $51,500. 1/4. Any difference in value will not be considered theft or loss. g. Salaries for the last half of December, payable in January, amount to $5,500 JEN estimates that of the Accounts Receivable S% will not be collectable..3 red: a. Prepare in journal form, any required correcting entries h. prepare in Journal form, all end-of-the period adjusting entries c. prepare a December adjusted trial balance d. prepare a classified balance sheet for the year ended December 31, 2014 e. prepare in journal form, the closing entries for the year ended December 31, 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts