Question: ** A O== NO NO 17% = Blackboard Question Completion Status QUESTION 2 Budget variances for incomes and expenses should be analyzed to see if

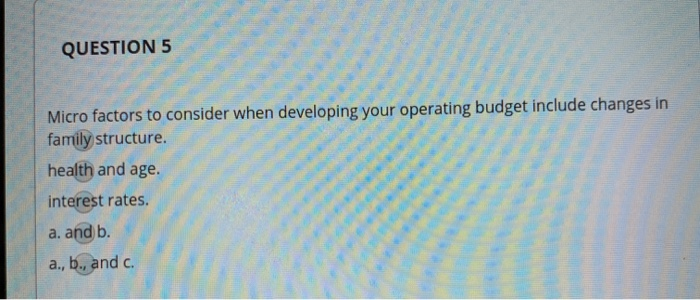

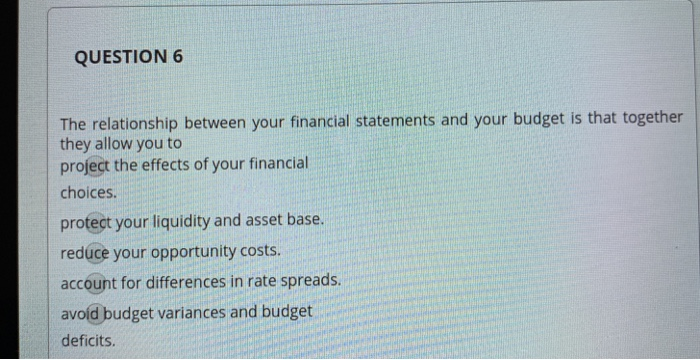

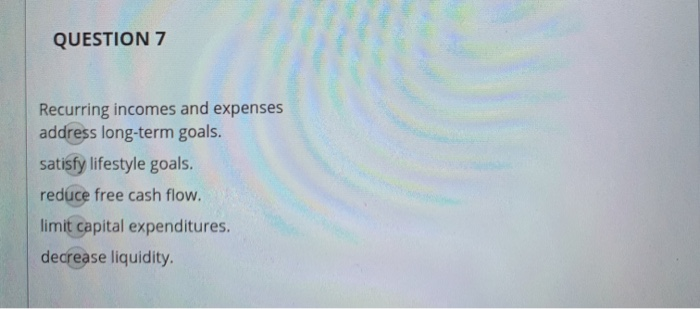

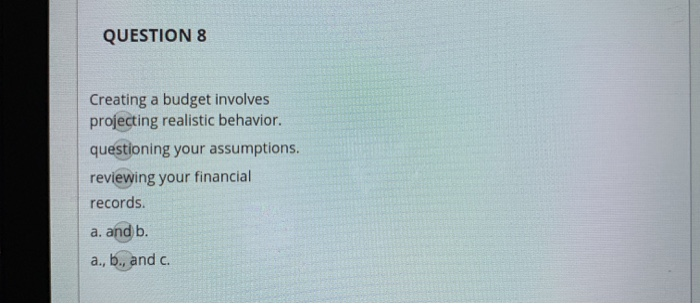

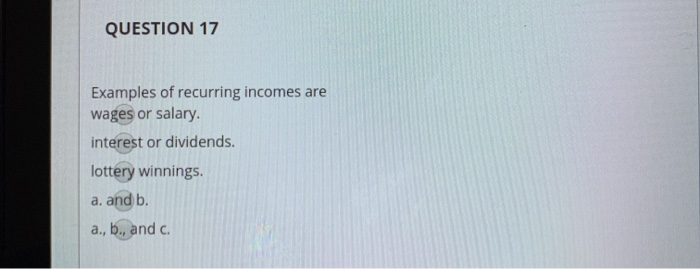

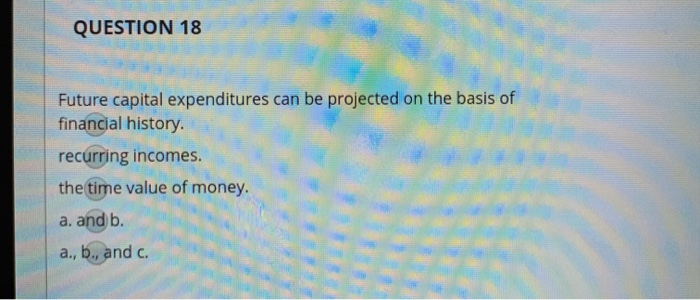

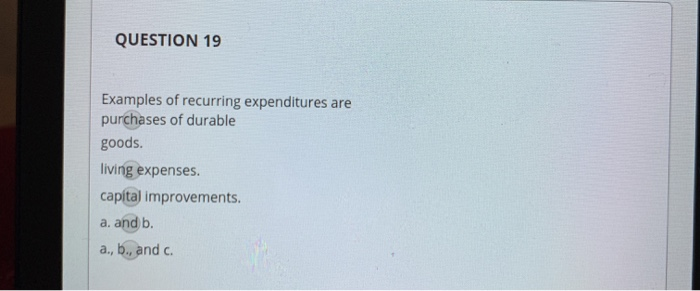

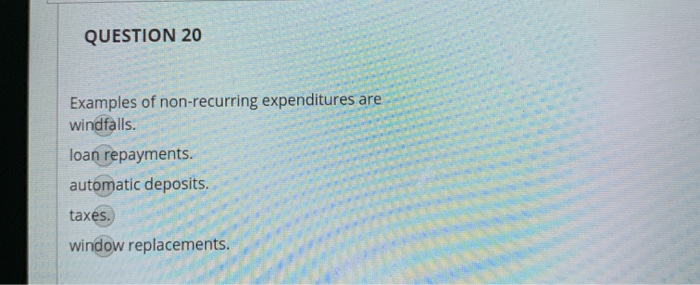

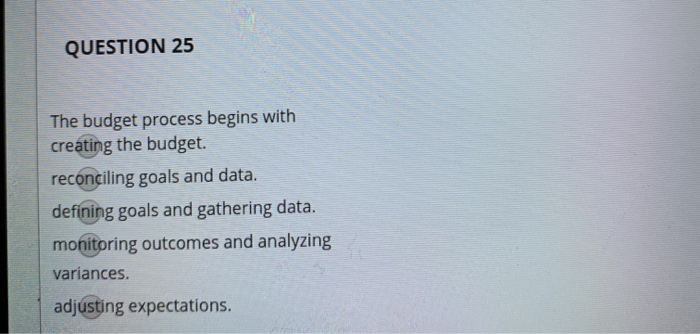

** A O== NO NO 17% = Blackboard Question Completion Status QUESTION 2 Budget variances for incomes and expenses should be analyzed to see if the caused by a difference in actual quantity, actual price, or both. projected incomes and/or expenditures. microeconomic or macroeconomic factors. a. and b. a., b., and c. 4 points Save Ans QUESTION 3 QUESTION 2 Budget variances for incomes and expenses should be analyzed to see if they are caused by a difference in actual quantity, actual price, or both. projected incomes and/or expenditures. microeconomic or macroeconomic factors. a. and b. a., b., and c. QUESTION 3 All the following assets or activities would be appropriate for developing a specialized budget EXCEPT tax consequences. operating expenses. an inheritance. a new recreational activity cash flows. QUESTION 4 A comprehensive budget includes projections of recurring incomes and expenses. non-recurring expenditures. non-recurring income. a. and b. a., b., and c. QUESTION 5 Micro factors to consider when developing your operating budget include changes in family structure. health and age. interest rates. a. and b. a., b., and c. QUESTION 6 The relationship between your financial statements and your budget is that together they allow you to project the effects of your financial choices. protect your liquidity and asset base. reduce your opportunity costs. account for differences in rate spreads. avoid budget variances and budget deficits. QUESTION 7 Recurring incomes and expenses address long-term goals. satisfy lifestyle goals. reduce free cash flow. limit capital expenditures. decrease liquidity QUESTION 8 Creating a budget involves projecting realistic behavior. questioning your assumptions. reviewing your financial records. a. and b. a., b., and c. QUESTION 9 Budgets can be prepared conservatively by underestimating costs. underestimating earnings. overestimating goals. overestimating results. reconciling behaviors and goals. QUESTION 10 A budget for short-term goals involving recurring items is called a(n) operating budget comprehensive budget. capital budget. a. and b. a., b., and c. QUESTION 11 A budget for long-term goals involving non-recurring items is called a(n) operating budget comprehensive budget. capital budget a. and b. a., b., and c. QUESTION 12 The budget process begins with a thorough understanding of your current financial condition. financial statements. desires and choices. a. and b. a., b., and c. QUESTION 13 A comprehensive budget may include any of the following components EXCEPT a specialized budget. a tax budget. a cash flow statement. an operating budget. a capital budget QUESTION 14 Recurring incomes and expenditures must be evaluated in terms of the reliability of the source. the frequency of the recurrence the amount of the cash flow. a. and b. a., b., and c. QUESTION 15 Future incomes and expenses can be projected for quantity and price on the basis of probability. volatility. predictability a. and b. a., b., and c. 4 points Save Answer QUESTION 16 Macro factors to consider when developing your operating budget include changes in unemployment rates. price levels. career choices. a. and b. a., b., and c. QUESTION 17 Examples of recurring incomes are wages or salary. interest or dividends. lottery winnings. a. and b. a., b., and c. QUESTION 18 Future capital expenditures can be projected on the basis of financial history. recurring incomes. the time value of money. a. and b. a., b., and c. QUESTION 19 Examples of recurring expenditures are purchases of durable goods. living expenses. capital improvements. a. and b. a., b., and c. QUESTION 20 Examples of non-recurring expenditures are windfalls. loan repayments. automatic deposits. taxes. window replacements. QUESTION 21 The existence of a budget variance indicates that your estimate was inaccurate, factors changed unexpectedly. your budget needs readjusting a. and b. a., b., and c. QUESTION 22 The cash budget's greatest value is in clarifying risks and choices in the timing of cash flows. attainable short term goals and lifestyle goals. free cash flows for capital expenditures. recurring incomes and expenses. the importance of cash management tools. QUESTION 23 The appropriate time period for the budget process is based on being conservative in your expectations. reaching your financial goals. getting manageable and meaningful data. a. and b. a., b., and c. QUESTION 24 The timing of your budget process depends on how much financial activity you have. how much financial discipline you need. how much financial data you generate. a. and b. a., b., and C. QUESTION 25 The budget process begins with creating the budget. reconciling goals and data. defining goals and gathering data. monitoring outcomes and analyzing variances. adjusting expectations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts