Question: a . On April 1 , the start of the loan period, the cash balance will be ( $ 4 0 , 0

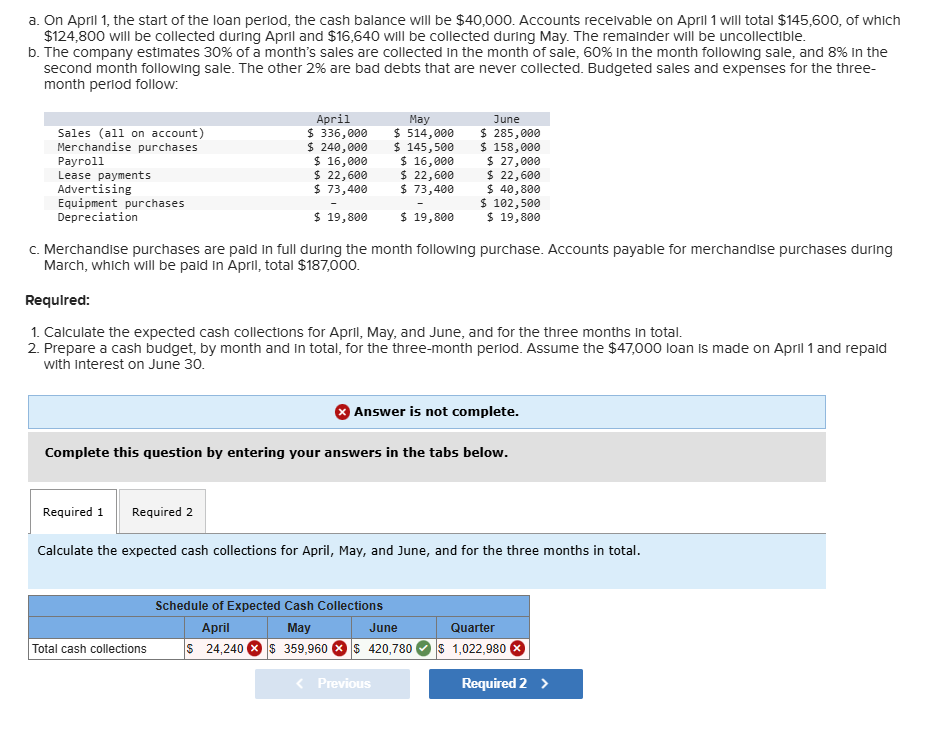

a On April the start of the loan period, the cash balance will be $ Accounts recelvable on April will total $ of which $ will be collected during April and $ will be collected during May. The remainder will be uncollectible. b The company estimates of a month's sales are collected in the month of sale, in the month following sale, and in the second month following sale. The other are bad debts that are never collected. Budgeted sales and expenses for the threemonth perlod follow: c Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases during March, which will be paid in April, total $ Required: Calculate the expected cash collections for April, May, and June, and for the three months in total. Prepare a cash budget, by month and in total, for the threemonth perlod. Assume the $ loan is made on Aprill and repaid with Interest on June Answer is not complete. Complete this question by entering your answers in the tabs below. Required Required Calculate the expected cash collections for April, May, and June, and for the three months in total. Complete this question by entering your answers in the tabs below.

Prepare a cash budget, by month and in total, for the threemonth period. Assume the $ loan is made on April and repaid with interest on June

Note: Cash deficiency, repayments and interest should be indicated by a minus sign.

begintabularccccccccc

hline multicolumncPrime Products

hline multicolumncCash Budget

hline & & April & & May & & June & & Quarter

hline multicolumnlBeginning cash balance

hline multicolumnlAdd receipts:

hline multicolumnlCollections from customers

hline Total cash available & & & & & & & &

hline multicolumnlLess cash disbursements:

hline multicolumnlMerchandise purchases

hline multicolumnlPayroll

hline multicolumnlLease payments

hline multicolumnlAdvertising

hline multicolumnlEquipment purchases

hline Total cash disbursements & & & & & & & &

hline Excess deficiency of cash available over disbursements & & & & & & & &

hline multicolumnlFinancing:

hline multicolumnlBorrowings

hline multicolumnlRepayments

hline multicolumnlInterest

hline Total financing & & & & & & & &

hline Ending cash balance & $ & & $ & & $ & & $ &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock