Question: a . On October 1 , 2 0 2 3 a business collected $ 5 , 0 0 0 rent in advance. The tenant was

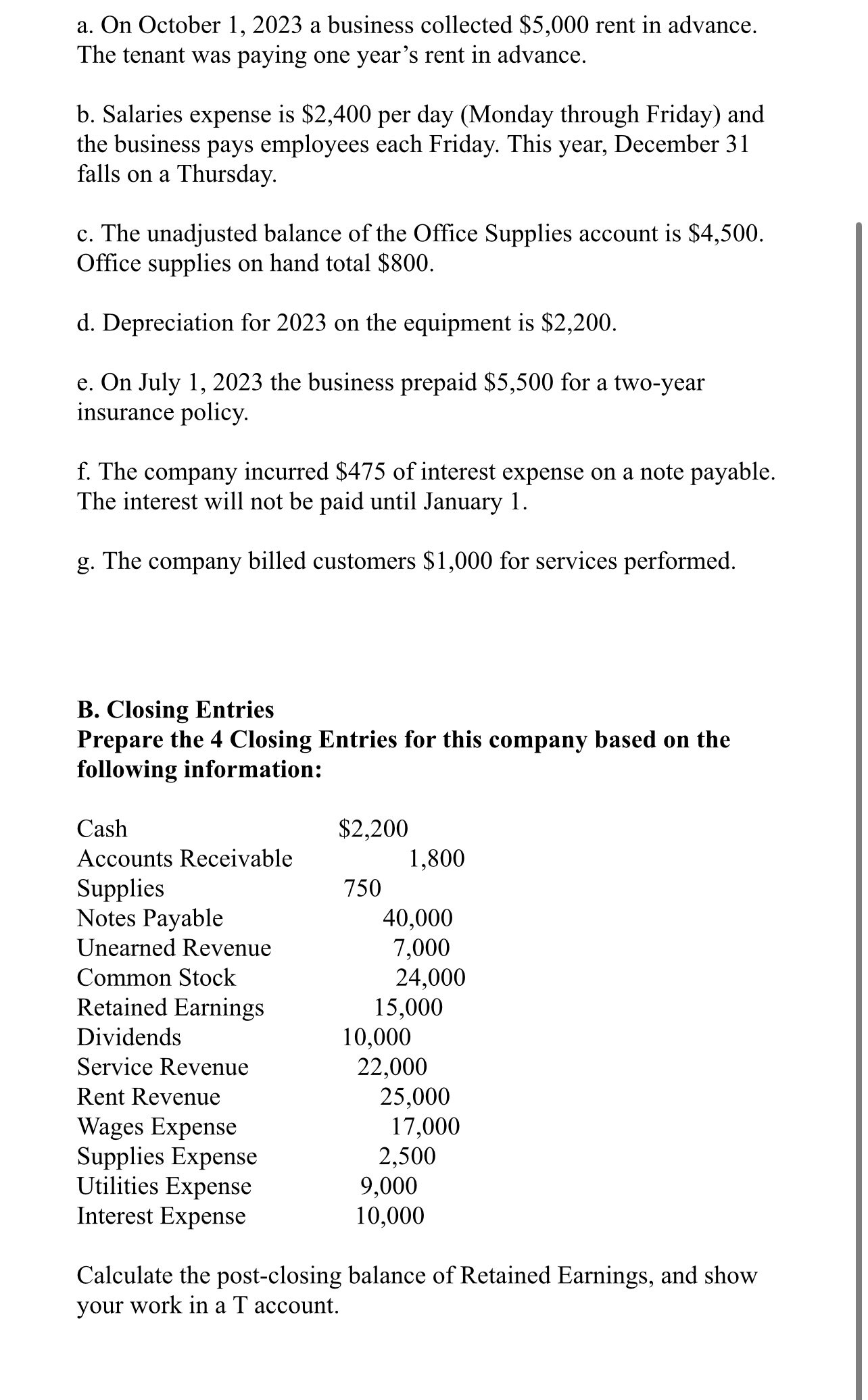

a On October a business collected $ rent in advance. The tenant was paying one year's rent in advance.

b Salaries expense is $ per day Monday through Friday and the business pays employees each Friday. This year, December falls on a Thursday.

c The unadjusted balance of the Office Supplies account is $ Office supplies on hand total $

d Depreciation for on the equipment is $

e On July the business prepaid $ for a twoyear insurance policy.

f The company incurred $ of interest expense on a note payable. The interest will not be paid until January

g The company billed customers $ for services performed.

B Closing Entries

Prepare the Closing Entries for this company based on the following information:

tableCash$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock