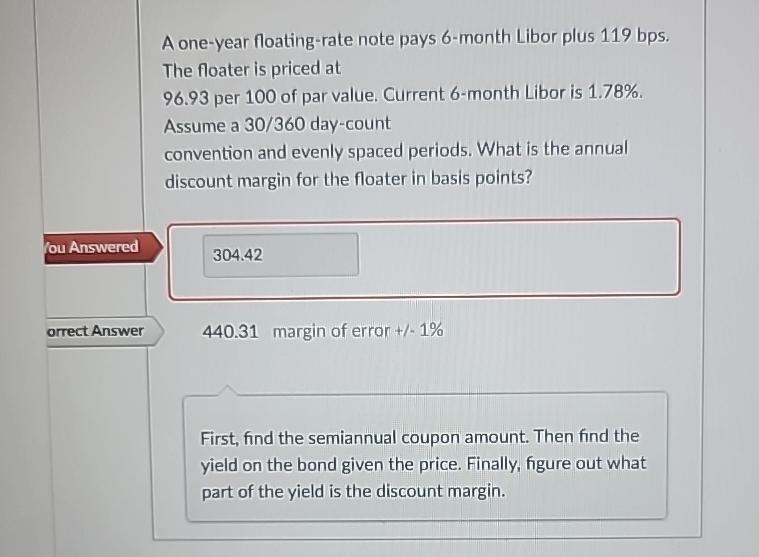

Question: A one - year floating - rate note pays 6 - month Libor plus 1 1 9 bps . The floater is priced at 9

A oneyear floatingrate note pays month Libor plus bps The floater is priced at per of par value. Current month Libor is Assume a daycount convention and evenly spaced periods. What is the annual discount margin for the floater in basis points?

ou Answered

margin of error

First, find the semiannual coupon amount. Then find the yield on the bond given the price. Finally, figure out what part of the yield is the discount margin.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock