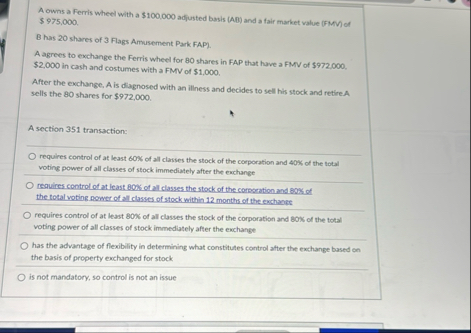

Question: A owns a Ferris wheel with a $ 1 0 0 , 0 0 0 adjusted basis ( AB ) and a fair market value

A owns a Ferris wheel with a $ adjusted basis AB and a fair market value FMM of $

B has shares of Flags Amusement Park FAP

A agrees to exchange the Ferris wheel for shares in FAP that have a FMVV of $ $ in cash and costumes with a FMV of $

After the exchange, A is diagnosed with an illiness and decides to sell his stock and retireA sells the shares for $

A section transaction:

requires control of at least K of all classes the stock of the corporation and K of the total voting power of all classes of stock immediately after the exchange

requires control of at least is of all classes the stock of the corroration and of the total voting nower of all classes of stock within months of the exch onge

requires control of at least of all classes the stock of the corporation and of the total voting power of all classes of stock immediately after the exchange

has the advantage of flexibility in determining what constitutes control after the exchange based on the basis of property exchanged for stock

is not mandatory, so control is not an issue

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock