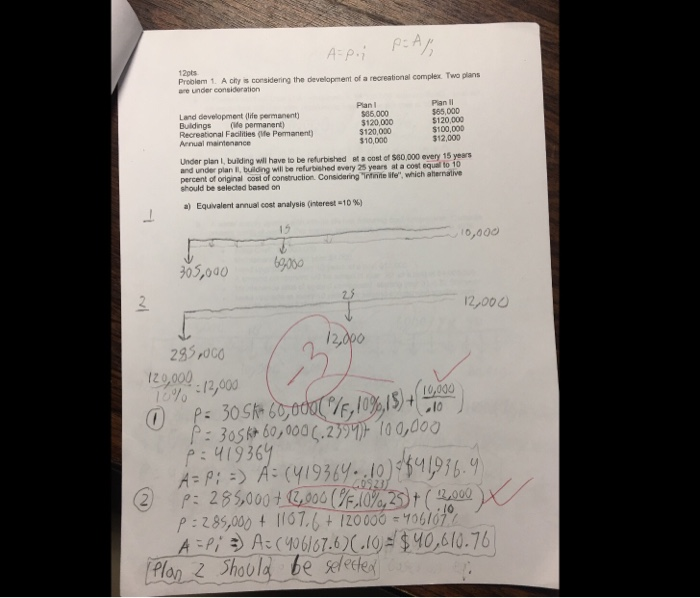

Question: A p.; PEAR 12pts Problem 1. Ach is considering the development of a recreational complex. Two plans are under consideration Plan Plan il Land development

A p.; PEAR 12pts Problem 1. Ach is considering the development of a recreational complex. Two plans are under consideration Plan Plan il Land development (life permanent) $85.000 555.000 Buildings (ue permanent) $120 000 $120.000 Recreational Facilities (We Permanent) $120.000 $100,000 Annual maintenance $10,000 $12.000 Under plan, bulding will have to be refurbished at a cost of $80.000 every 15 years and under plan II, building will be refurbished every 25 years at a cost equal to 10 percent of original cost al construction. Considering infine life which alernative should be selected based on a) Equivalent annual cost analysis (interest -10%) 10,000 69,000 305,000 12,000 20 10% 12,000 285,000 120,000 (10,000 P= 30 5460,000/F 0%,/5)+ 10 p=3054 60,000 6.23947 700,000 P: 419364 A = p; =) A = (419364..10)=841936.4 P: 285,000+ 0,000 (.10%,25+ (2,000 2:285,000 + 1107.6 + 120000 = 406707 A=P; =) A = (406167.6) (10) = $40,610.761 Plan 2 should be selected as

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts