Question: A part please CHECK FIGURES: 2. Bad Debt Expense = $118,160; 5. Bad Debt Expense = $35,940 Wondra Supplies showed the following selected adjusted balances

A part please

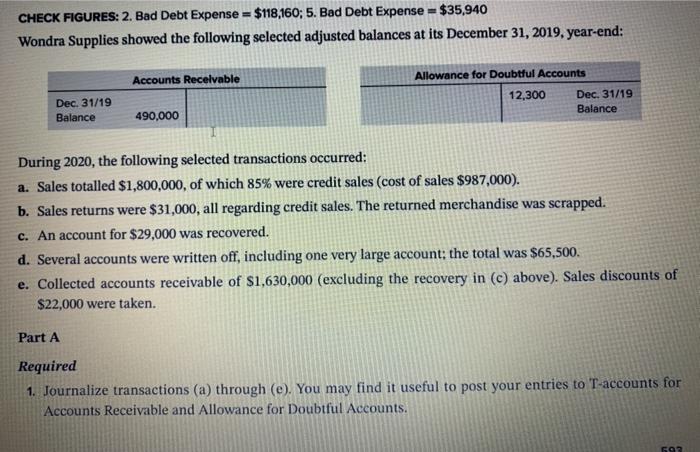

A part pleaseCHECK FIGURES: 2. Bad Debt Expense = $118,160; 5. Bad Debt Expense = $35,940 Wondra Supplies showed the following selected adjusted balances at its December 31, 2019, year-end: Accounts Receivable Allowance for Doubtful Accounts 12,300 Dec. 31/19 Balance Dec. 31/19 Balance 490,000 During 2020, the following selected transactions occurred: a. Sales totalled $1,800,000, of which 85% were credit sales (cost of sales $987,000). b. Sales returns were $31,000, all regarding credit sales. The returned merchandise was scrapped. c. An account for $29,000 was recovered. d. Several accounts were written off, including one very large account; the total was $65,500. e. Collected accounts receivable of $1,630,000 (excluding the recovery in (c) above). Sales discounts of $22,000 were taken. Part A Required 1. Journalize transactions (a) through (e). You may find it useful to post your entries to T-accounts for Accounts Receivable and Allowance for Doubtful Accounts. 693

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts