Question: A partial amortization schedule for a note payable with interest paid annually that was issued on January 1, Year 1, is shown next Principal

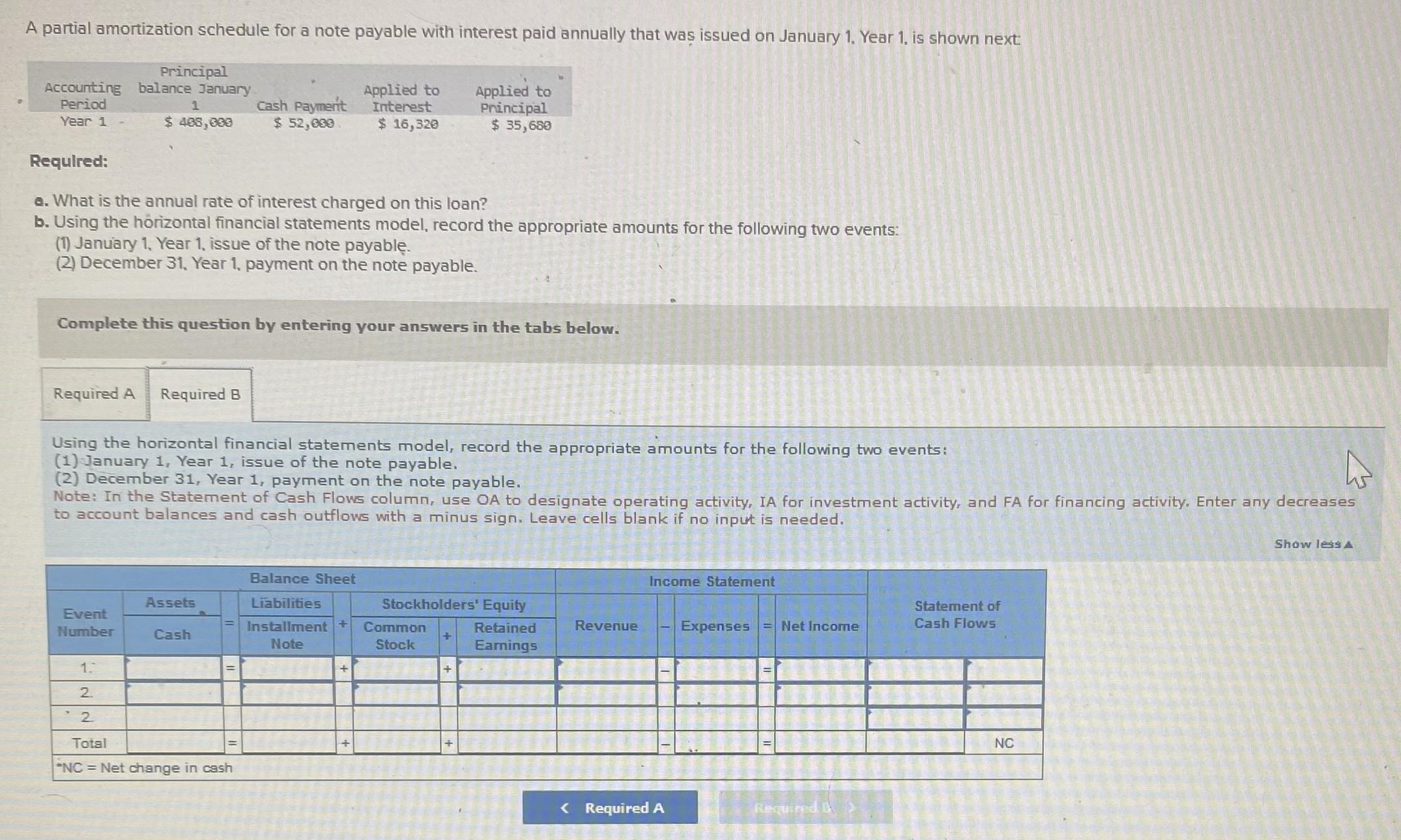

A partial amortization schedule for a note payable with interest paid annually that was issued on January 1, Year 1, is shown next Principal Accounting balance January Period Year 1 1 $ 485,600 Required: Applied to Principal Cash Payment $ 52,000 Applied to Interest $ 16,320 $ 35,680 a. What is the annual rate of interest charged on this loan? b. Using the horizontal financial statements model, record the appropriate amounts for the following two events: (1) January 1, Year 1, issue of the note payable. (2) December 31, Year 1, payment on the note payable. Complete this question by entering your answers in the tabs below. Required A Required B Using the horizontal financial statements model, record the appropriate amounts for the following two events: (1) January 1, Year 1, issue of the note payable. (2) December 31, Year 1, payment on the note payable. Note: In the Statement of Cash Flows column, use OA to designate operating activity, IA for investment activity, and FA for financing activity. Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Balance Sheet Assets Event Number Cash Liabilities Installment + Note Stockholders' Equity Common Stock + Retained Earnings Revenue 1. + 2 2 Total *NC=Net change in cash Income Statement Statement of Expenses Net Income Cash Flows < Required A Requir NC Show les

Step by Step Solution

There are 3 Steps involved in it

a To calculate the annual rate of interest charged on this loan we can use the formula Interest Expe... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

663da4d51b0cb_964044.pdf

180 KBs PDF File

663da4d51b0cb_964044.docx

120 KBs Word File