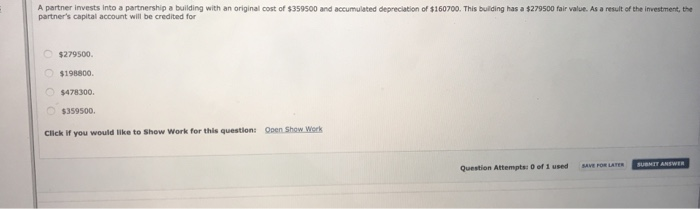

Question: A partner invests into a partnership a building with an original cost of $359500 and accumulated depreciation of $160700. This building has a $279500 fair

A partner invests into a partnership a building with an original cost of $359500 and accumulated depreciation of $160700. This building has a $279500 fair value. As a result of the investment, the partner's capital account will be credited for $279500. $198800. $478300. $359500. Open Show Work Click if you would like to Show Work for this question: SUBMIT ANSWER AVE FOR LAr Question Attempts: 0 of 1 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts