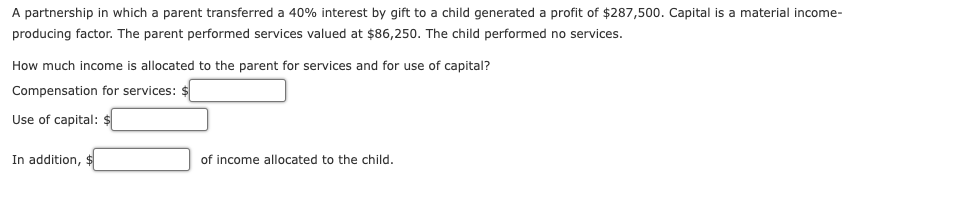

Question: A partnership in which a parent transferred a 40% interest by gift to a child generated a profit of $287,500. Capital is a material income-

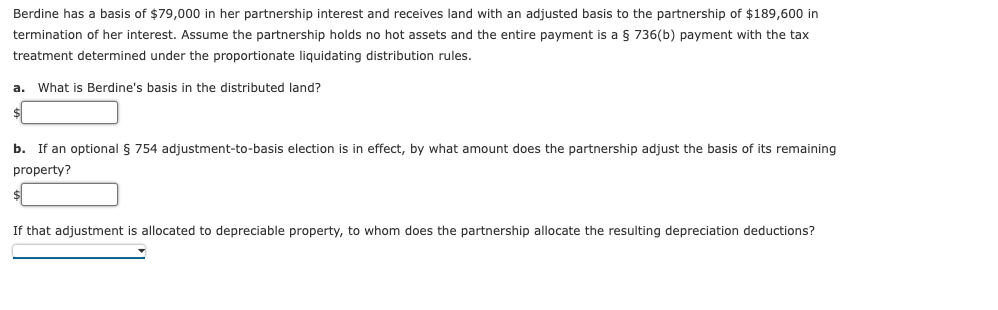

A partnership in which a parent transferred a 40% interest by gift to a child generated a profit of $287,500. Capital is a material income- producing factor. The parent performed services valued at $86,250. The child performed no services. How much income is allocated to the parent for services and for use of capital? Compensation for services: $ Use of capital: $ In addition, $ of income allocated to the child. Berdine has a basis of $79,000 in her partnership interest and receives land with an adjusted basis to the partnership of $189,600 in termination of her interest. Assume the partnership holds no hot assets and the entire payment is a 736(b) payment with the tax treatment determined under the proportionate liquidating distribution rules. a. What is Berdine's basis in the distributed land? b. If an optional 754 adjustment-to-basis election is in effect, by what amount does the partnership adjust the basis of its remaining property? If that adjustment is allocated to depreciable property, to whom does the partnership allocate the resulting depreciation deductions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts