Question: A partnership is owned by three equal partners A, B, & C. Partner A has a fiscal year-end of January 31st. Partner B has a

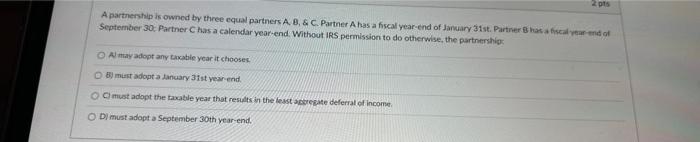

A partnership is owned by three equal partners A, B, & C. Partner A has a fiscal year-end of January 31st. Partner B has a fiscal year-end of September 30; Partner C has a calendar year-end. Without IRS permission to do otherwise, the partnership:

A) may adopt any taxable year it chooses.

B) must adopt a January 31st year-end.

C) must adopt the taxable year that results in the least aggregate deferral of income.

D) must adopt a September 30th year-end.

A partnership is ownod by three equal partners A, 8, \& C. Parther A has a fiscal year-end of January 3ist. Partiner 8 has a fiscal vear mid of September 30: Parther C has a calendar year-end. Without IRS permission to do otherwise, the partnershig: A) may adopt any thoable ycar it chooses. B) must adopt a tancuary 3 ist year end. O must adopt the taxable year that results in the lesst spocerase deferrat of incomet. Di must adopt a September 30 th vear-end

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock