Question: A payday loan is structured to obscure the true interest rate you are paying. For example, in Washington, you pay a $29 fee for a

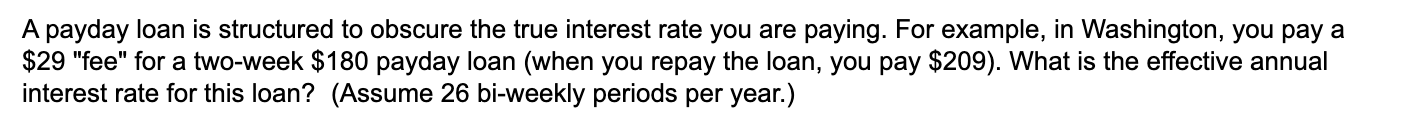

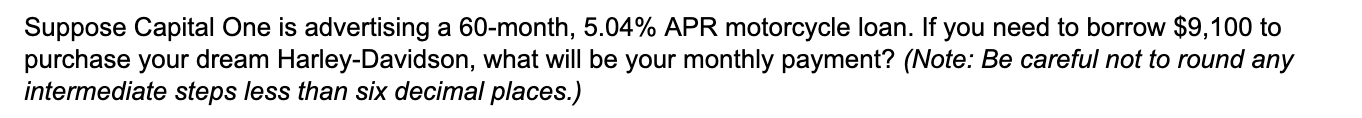

A payday loan is structured to obscure the true interest rate you are paying. For example, in Washington, you pay a $29 "fee" for a two-week $180 payday loan (when you repay the loan, you pay $209). What is the effective annual interest rate for this loan? (Assume 26 bi-weekly periods per year.) Suppose Capital One is advertising a 60-month, 5.04% APR motorcycle loan. If you need to borrow $9,100 to purchase your dream Harley-Davidson, what will be your monthly payment? (Note: Be careful not to round any intermediate steps less than six decimal places.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock