Question: A payroll register does not include: Pay period dates. Hours worked. Gross pay and net pay. Deductions. Employer tax expenses. A table that shows the

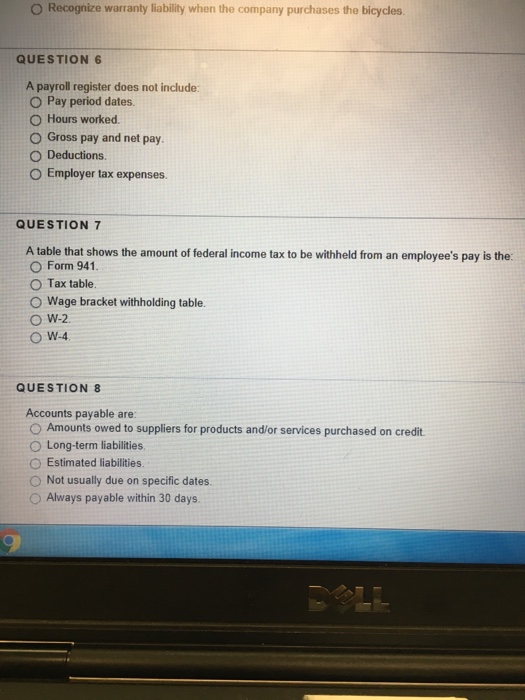

A payroll register does not include: Pay period dates. Hours worked. Gross pay and net pay. Deductions. Employer tax expenses. A table that shows the amount of federal income tax to be withheld from an employee's pay is the: Form 941. Tax table. Wage bracket withholding table. W-2. W-4. Accounts payable are: Amounts owed to suppliers for products and/or services purchased on credit. Long-term liabilities. Estimated liabilities. Not usually due on specific dates. Always payable within 30 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts