Question: A pension fund manager is considering three assets. The first is a stock fund, the second is a long-term government and corporate bond fund, and

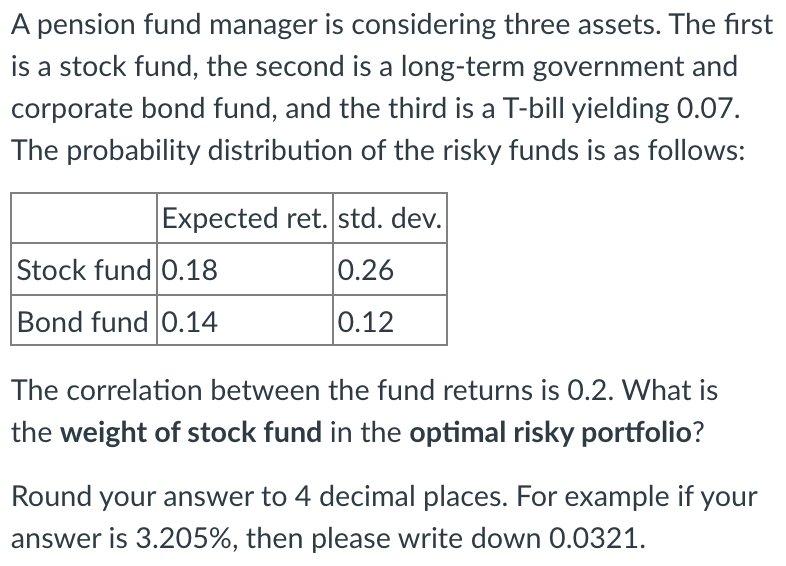

A pension fund manager is considering three assets. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill yielding 0.07. The probability distribution of the risky funds is as follows: Expected ret. std. dev. Stock fund 0.18 0.26 Bond fund 0.14 0.12 The correlation between the fund returns is 0.2. What is the weight of stock fund in the optimal risky portfolio? Round your answer to 4 decimal places. For example if your answer is 3.205%, then please write down 0.0321

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock