Question: A pension fund must make two fixed payments (2 liabilities). The first is payment of $100M in 10 years. The second is a payment of

A pension fund must make two fixed payments (2 liabilities). The first is payment of $100M in 10 years. The second is a payment of $50M in 30 years. The current market interest rate is 3% at all maturities. The fund has $100M available to invest. The fund can allocate its assets between a 5-year zero-coupon and a 20-year zero-coupon bond. The fund wants to stabilize its equity/assets ratio.

What face value of 20 year bonds would you recommend for the fund after the yield jump from 3% to 4%?

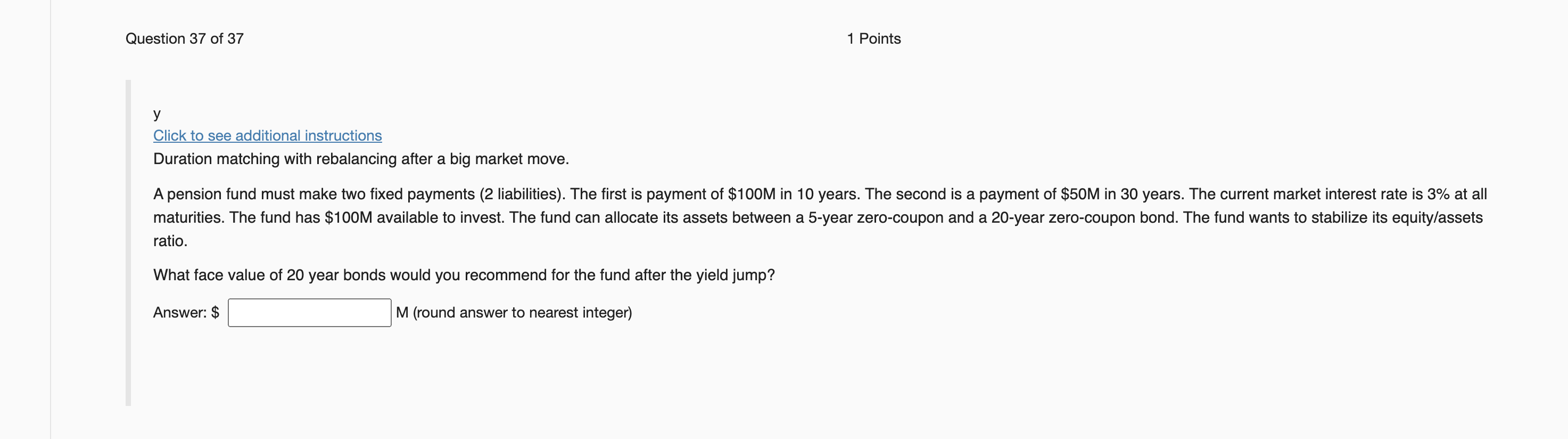

Question 37 of 37 1 Points y Click to see additional instructions Duration matching with rebalancing after a big market move. A pension fund must make two fixed payments (2 liabilities). The first is payment of $100M in 10 years. The second is a payment of $50M in 30 years. The current market interest rate is 3% at all maturities. The fund has $100M available to invest. The fund can allocate its assets between a 5-year zero-coupon and a 20-year zero-coupon bond. The fund wants to stabilize its equity/assets ratio. What face value of 20 year bonds would you recommend for the fund after the yield jump? Answer: $ M (round answer to nearest integer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts