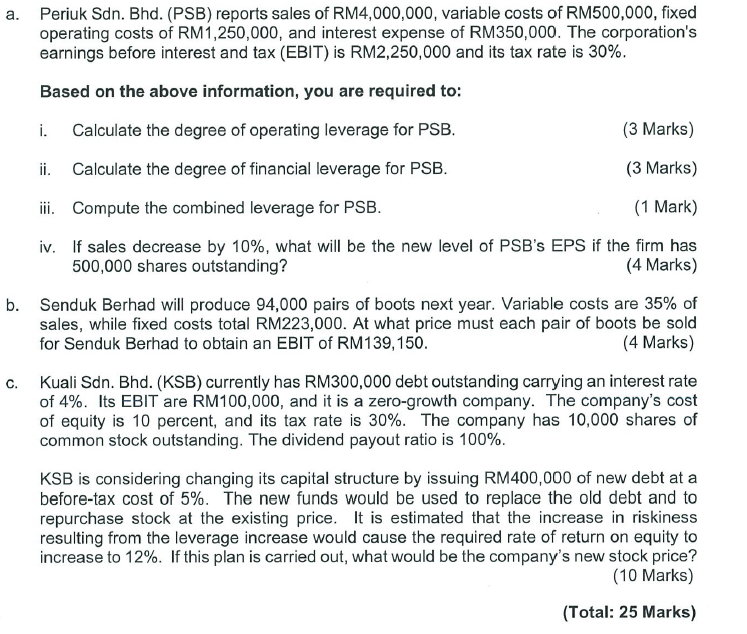

Question: a . Periuk S d n . B h d . ( P S B ) reports sales o f R M 4 , 0

Periuk reports sales variable costs fixed

operating costs and interest expense The corporation's

earnings before interest and tax and its tax rate

Based the above information, you are required :

Calculate the degree operating leverage for

Marks

Calculate the degree financial leverage for

Marks

iii. Compute the combined leverage for

Mark

sales decrease what will the new level EPS the firm has

shares outstanding?

Marks

Senduk Berhad will produce pairs boots next year. Variable costs are

sales, while fixed costs total what price must each pair boots sold

for Senduk Berhad obtain EBIT

Marks

Kuali currently has debt outstanding carrying interest rate

Its EBIT are and a zerogrowth company. The company's cost

equity percent, and its tax rate The company has shares

common stock outstanding. The dividend payout ratio

considering changing its capital structure issuing new debt

beforetax cost The new funds would used replace the old debt and

repurchase stock the existing price. estimated that the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock