Question: A perpetuity will pay $ 1 , 0 0 0 per year, starting five years after the perpetuity is purchased. What is the present value

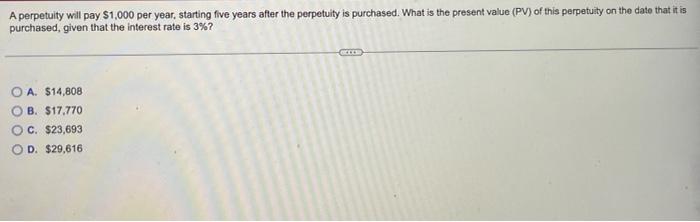

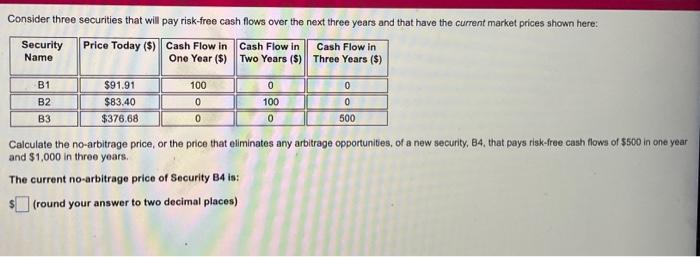

A perpetuity will pay $1,000 per year, starting five years after the perpetuily is purchased. What is the present value (PV) of this perpetuity on the date that it is purchased, given that the interest rate is 3% ? A. $14,808 B. $17,770 C. $23,693 D. $29,616 Calculate the no-arbitrage price, or the price that eliminates any arbitrage opportunities, of a new security, B4, that pays risk-free cash flows of $500 in one year and $1,000 in three years. The current no-arbitrage price of Security B4 is: (round your answer to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts