Question: a) Peter develops a portfolio with expected return of 12% per year over the next 20 years for his retirement plan. He constructed a portfolio

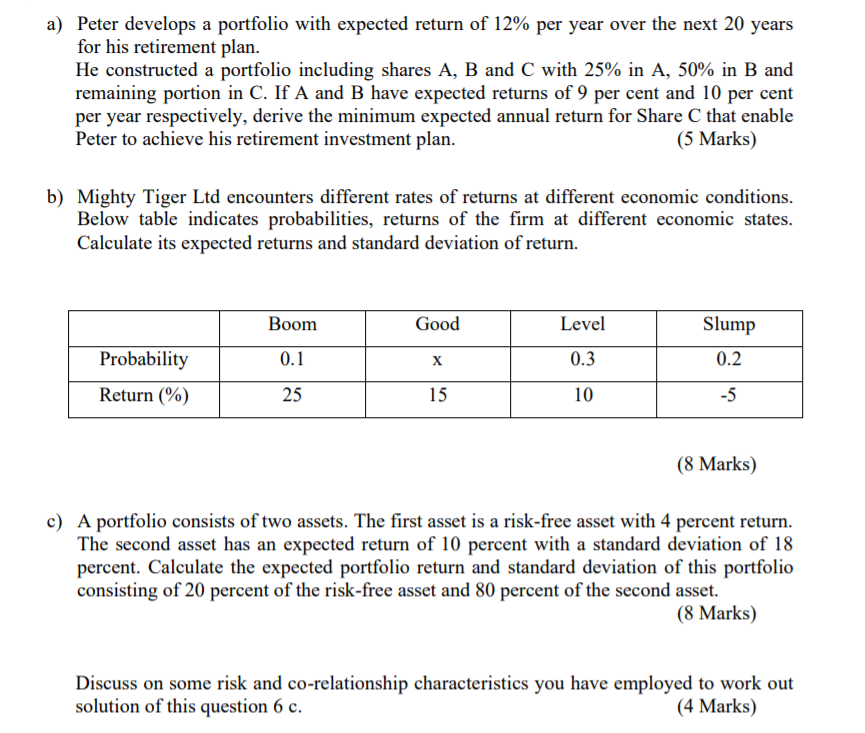

a) Peter develops a portfolio with expected return of 12% per year over the next 20 years for his retirement plan. He constructed a portfolio including shares A, B and C with 25% in A, 50% in B and remaining portion in C. If A and B have expected returns of 9 per cent and 10 per cent per year respectively, derive the minimum expected annual return for Share C that enable Peter to achieve his retirement investment plan. (5 Marks) b) Mighty Tiger Ltd encounters different rates of returns at different economic conditions. Below table indicates probabilities, returns of the firm at different economic states. Calculate its expected returns and standard deviation of return. Boom Good Level Slump 0.2 0.1 X 0.3 Probability Return (%) 25 15 10 -5 (8 Marks) c) A portfolio consists of two assets. The first asset is a risk-free asset with 4 percent return. The second asset has an expected return of 10 percent with a standard deviation of 18 percent. Calculate the expected portfolio return and standard deviation of this portfolio consisting of 20 percent of the risk-free asset and 80 percent of the second asset. (8 Marks) Discuss on some risk and co-relationship characteristics you have employed to work out solution of this question 6 c. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts