Question: a) Pfizer plans to acquire Warner-Lambert by making a cash offer of $27 a share for all 100,000 shares of Warner-Lambert. It estimates that the

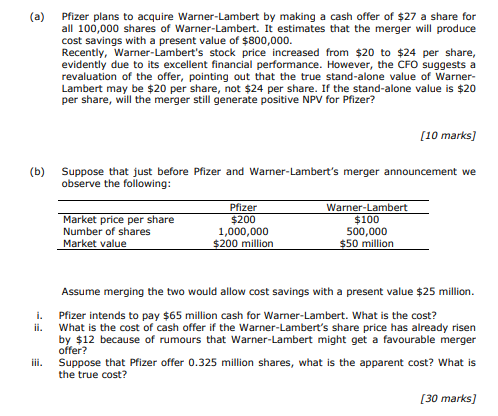

a) Pfizer plans to acquire Warner-Lambert by making a cash offer of $27 a share for all 100,000 shares of Warner-Lambert. It estimates that the merger will produce cost savings with a present value of $800,000. Recently, Warner-Lambert's stock price increased from $20 to $24 per share, evidently due to its excellent financial performance. However, the CFO suggests a revaluation of the offer, pointing out that the true stand-alone value of WarnerLambert may be $20 per share, not $24 per share. If the stand-alone value is $20 per share, will the merger still generate positive NPV for Pfizer? [10 marks] Suppose that just before Pfizer and Warner-Lambert's merger announcement we observe the following: Assume merging the two would allow cost savings with a present value $25 million. Pfizer intends to pay $65 million cash for Warner-Lambert. What is the cost? What is the cost of cash offer if the Warner-Lambert's share price has already risen by $12 because of rumours that Warner-Lambert might get a favourable merger offer? Suppose that Pfizer offer 0.325 million shares, what is the apparent cost? What is the true cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts