Question: A physical count on May 31, 2012, shows 2,000 units of part M.O. on hand. Using the FIFO method, what is the cost of part

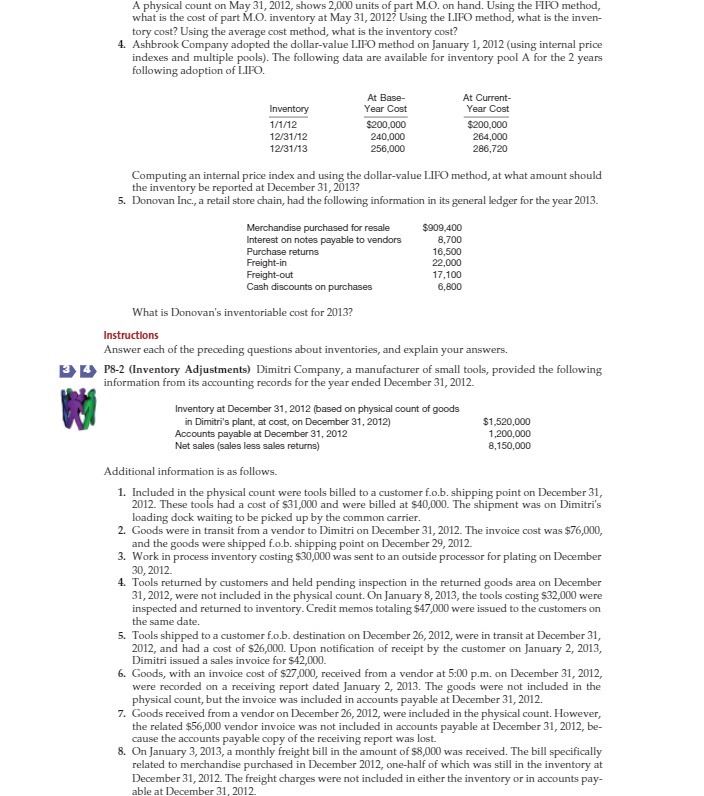

A physical count on May 31, 2012, shows 2,000 units of part M.O. on hand. Using the FIFO method, what is the cost of part M.O. inventory at May 31, 2012? Using the LIFO method, what is the inven- tory cost? Using the average cost method, what is the inventory cost? 4. Ashbrook Company adopted the dollar-value LIFO method on January 1, 2012 (using internal price indexes and multiple pools). The following data are available for inventory pool A for the 2 years following adoption of LIFO. At Base- At Current- Inventory Year Cost Year Cost 1/1/12 $200,000 $200,000 12/31/12 240,000 264,000 12/31/13 256,000 286,720 Computing an internal price index and using the dollar-value LIFO method, at what amount should the inventory be reported at December 31, 2013? 5. Donovan Inc., a retail store chain, had the following information in its general ledger for the year 2013. Merchandise purchased for resale $909,400 Interest on notes payable to vendors 8,700 Purchase returns 16,500 Freight-in 22,000 Freight-out 17,100 Cash discounts on purchases 6,800 What is Donovan's inventoriable cost for 2013? Instructions Answer each of the preceding questions about inventories, and explain your answers. 34) P8-2 (Inventory Adjustments) Dimitri Company, a manufacturer of small tools, provided the following information from its accounting records for the year ended December 31, 2012. Inventory at December 31, 2012 (based on physical count of goods in Dimitri's plant, at cost, on December 31, 2012) $1,520,000 Accounts payable at December 31, 2012 1,200,000 Net sales (sales less sales returns) 8,150,000 Additional information is as follows. 1. Included in the physical count were tools billed to a customer f.o.b. shipping point on December 31, 2012. These tools had a cost of $31,000 and were billed at $40,000. The shipment was on Dimitri's loading dock waiting to be picked up by the common carrier. 2. Goods were in transit from a vendor to Dimitri on December 31, 2012. The invoice cost was $76,000, `and the goods were shipped f.o.b. shipping point on December 29, 2012. 3. Work in process inventory costing $30,000 was sent to an outside processor for plating on December 30, 2012. 4. Tools returned by customers and held pending inspection in the returned goods area on December 31, 2012, were not included in the physical count. On January 8, 2013, the tools costing $32,000 were inspected and returned to inventory. Credit memos totaling $47,000 were issued to the customers on the same date. 5. Tools shipped to a customer f.o.b. destination on December 26, 2012, were in transit at December 31, 2012, and had a cost of $26,000. Upon notification of receipt by the customer on January 2, 2013, Dimitri issued a sales invoice for $42,000. 6. Goods, with an invoice cost of $27,000, received from a vendor at 5:00 p.m. on December 31, 2012, were recorded on a receiving report dated January 2, 2013. The goods were not included in the physical count, but the invoice was included in accounts payable at December 31, 2012. 7. Goods received from a vendor on December 26, 2012, were included in the physical count. However, the related $56,000 vendor invoice was not included in accounts payable at December 31, 2012, be- cause the accounts payable copy of the receiving report was lost. 8. On January 3, 2013, a monthly freight bill in the amount of $8,000 was received. The bill specifically related to merchandise purchased in December 2012, one-half of which was still in the inventory at December 31, 2012. The freight charges were not included in either the inventory or in accounts pay- able at December 31, 2012