Question: A Please complete Exercise as follows: 1) If a product sells for $200 per unit and its variable costs per unit are $130. The fixed

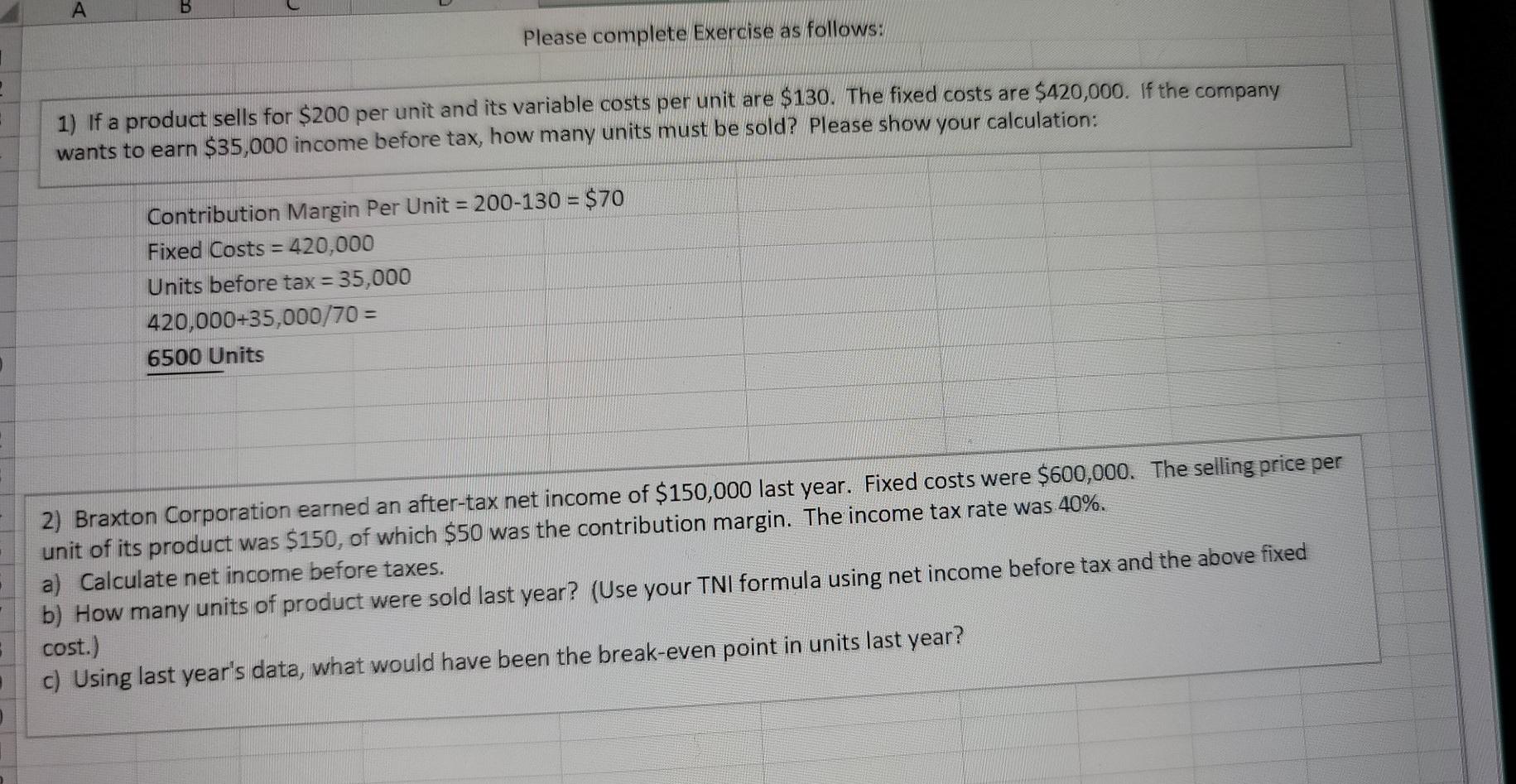

A Please complete Exercise as follows: 1) If a product sells for $200 per unit and its variable costs per unit are $130. The fixed costs are $420,000. If the company wants to earn $35,000 income before tax, how many units must be sold? Please show your calculation: Contribution Margin Per Unit = 200-130 = $70 Fixed Costs = 420,000 Units before tax = 35,000 420,000+35,000/70 = 6500 Units 2) Braxton Corporation earned an after-tax net income of $150,000 last year. Fixed costs were $600,000. The selling price per unit of its product was $150, of which $50 was the contribution margin. The income tax rate was 40%. a) Calculate net income before taxes. b) How many units of product were sold last year? (Use your TNI formula using net income before tax and the above fixed cost.) c) Using last year's data, what would have been the break-even point in units last year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts