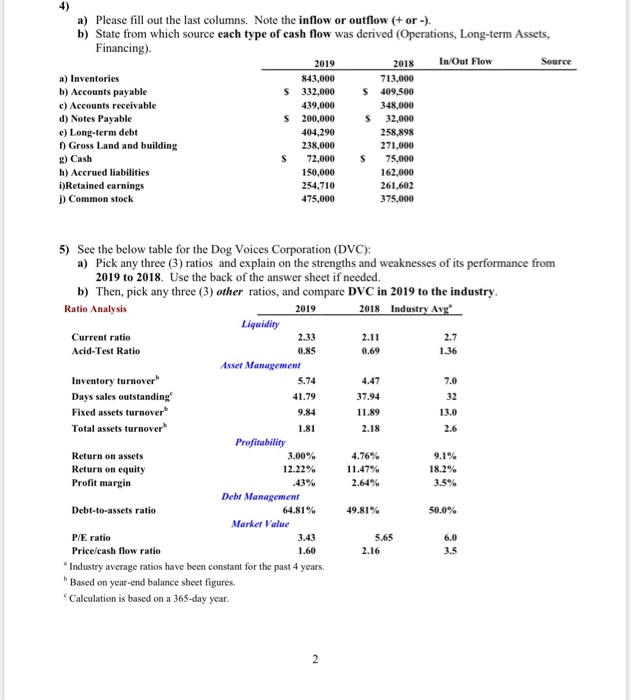

Question: a) Please fill out the last columns. Note the inflow or outflow [+ or -). b) State from which source each type of cash flow

a) Please fill out the last columns. Note the inflow or outflow [+ or -). b) State from which source each type of cash flow was derived (Operations, Long-term Assets, Financing). 2019 2018 In/Out Flow Source a) Inventories 843,000 713,000 b) Accounts payable S 332,000 $ 409,500 c) Accounts receivable 439,000 348,000 d) Notes Payable $ 200,000 s 32,000 e) Long-term debt 404,290 258,898 1) Gross Land and building 238,000 271,000 g) Cash s 72,000 s 75,000 h) Accrued liabilities 150,000 162,000 i)Retained earnings 254,710 261,602 j) Common stock 475,000 375,000 7.0 5) See the below table for the Dog Voices Corporation (DVC): a) Pick any three (3) ratios and explain on the strengths and weaknesses of its performance from 2019 to 2018. Use the back of the answer sheet if needed. b) Then, pick any three (3) other ratios, and compare DVC in 2019 to the industry. Ratio Analysis 2019 2018 Industry Avg Liquidity Current ratio 2.33 2.11 2.7 Acid-Test Ratio 0.85 0.69 1.36 Asset Management Inventory turnover" 5.74 4.47 Days sales outstanding 41.79 37.94 32 Fixed assets turnover 9.84 11.89 13.0 Total assets turnover 1.81 2.18 Profitability Return on assets 3.00% 4.76% 9.1% Return on equity 12.22% 11.47% 18.2% Profit margin .43% 2.64% 3.5% Debt Management Debt-to-assets ratio 64.81% 49.81% 50.0% Market Value P/E ratio 5.65 6.0 Price/cash flow ratio 1.60 2.16 3.5 Industry average ratios have been constant for the past 4 years. Based on year-end balance sheet figures. Calculation is based on a 365-day year. 2.6 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts