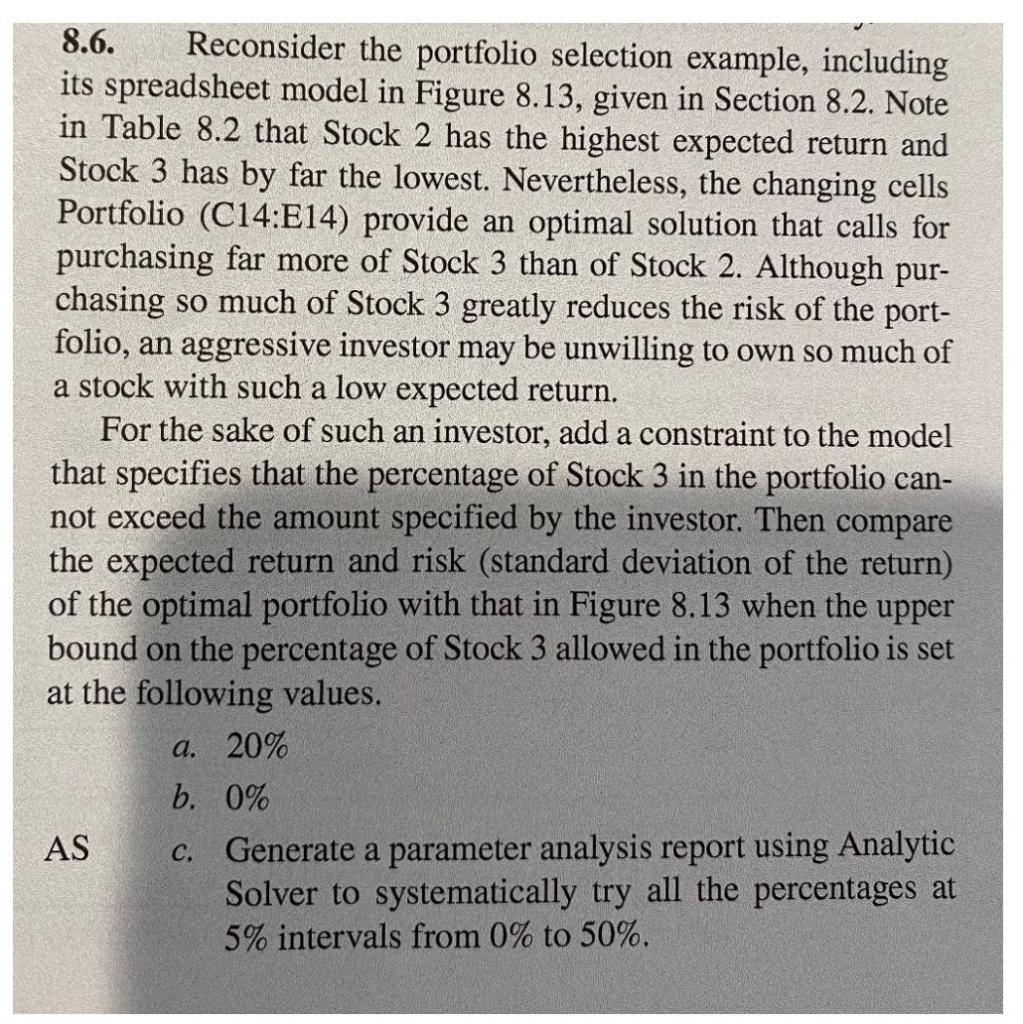

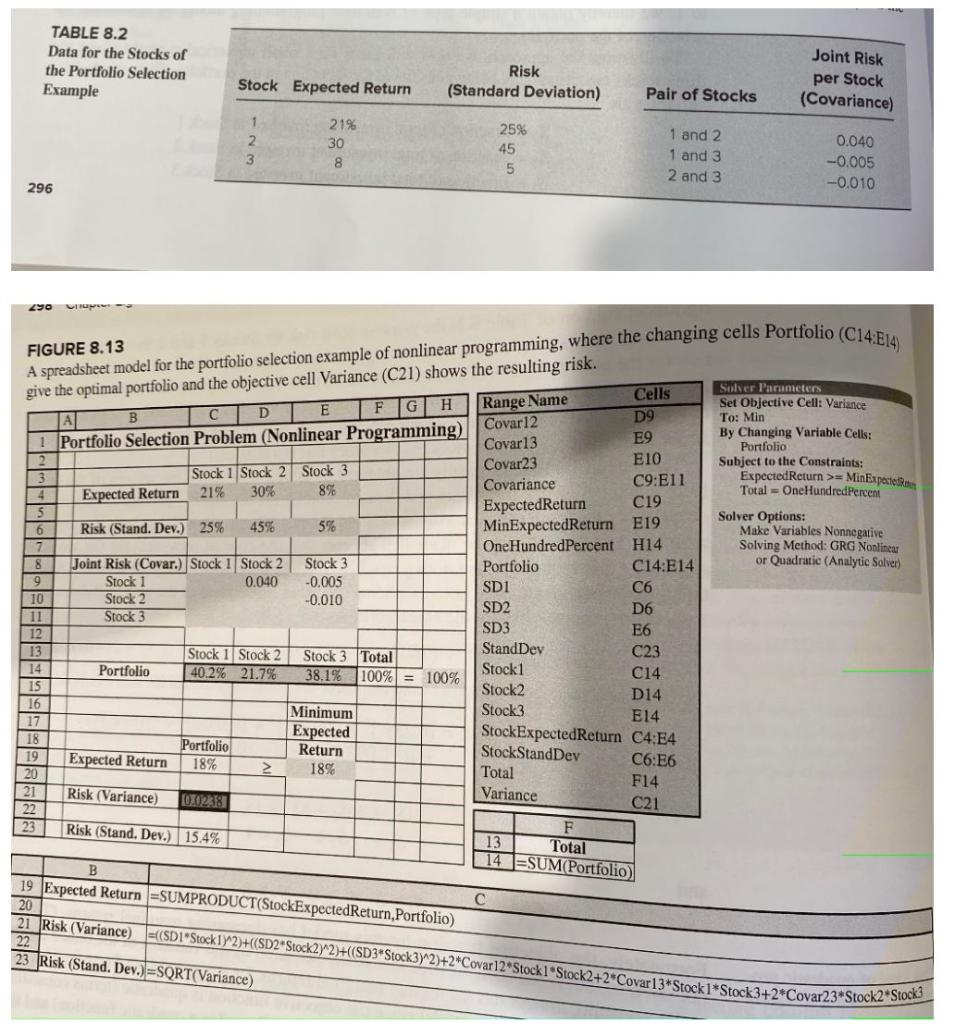

Question: a) Please write out the formulation clearly including decision variables, objective functions, and constraints. b) Please input your formulation from a) into solver and solver

a) Please write out the formulation clearly including decision variables, objective functions, and constraints.

b) Please input your formulation from a) into solver and solver the problem. Please show the excel screenshot of your answer.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts