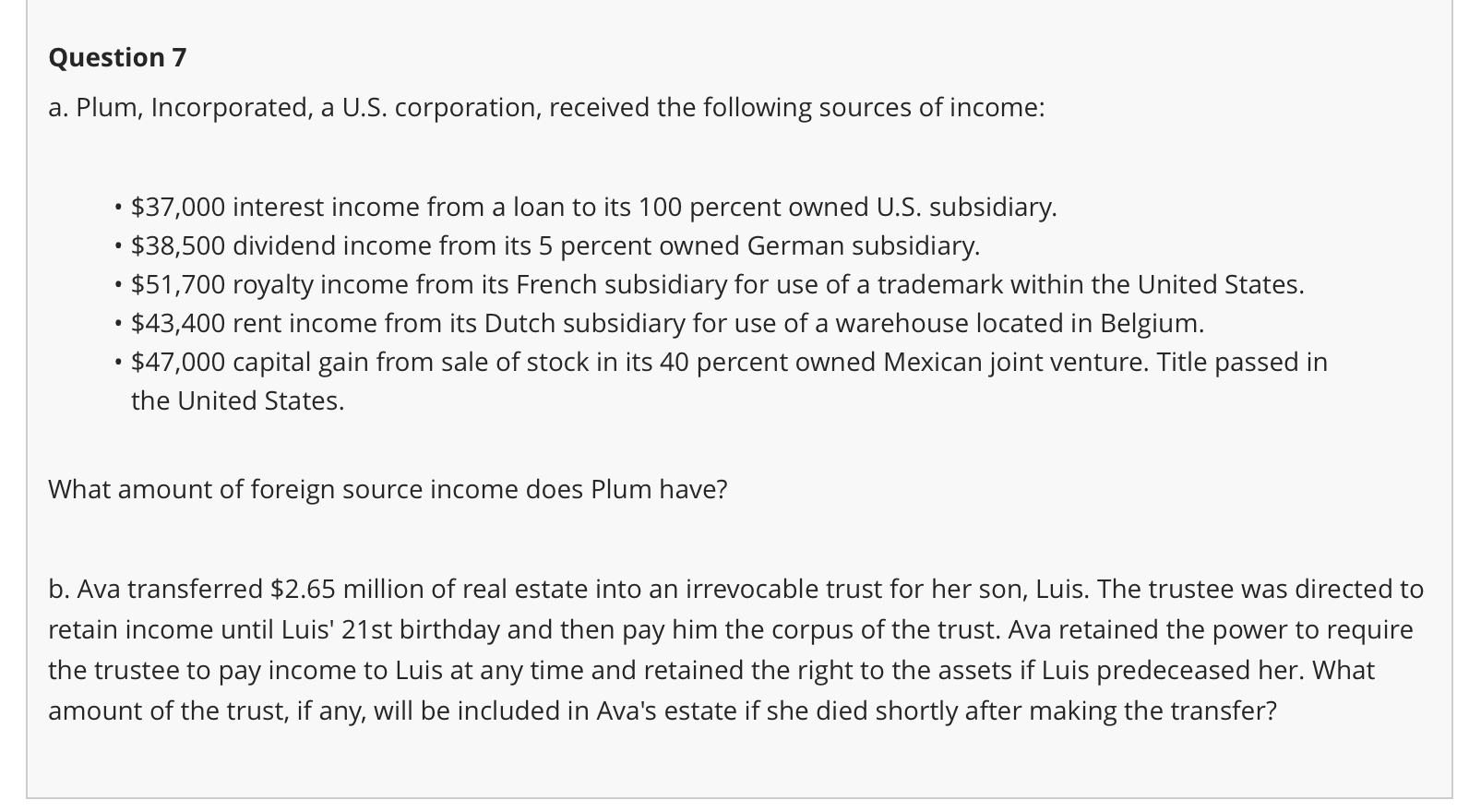

Question: A . Plum, Incorporated, a U . S . corporation, received the following sources of income: - $ 3 7 , 0 0 0 interest

A Plum, Incorporated, a US corporation, received the following sources of income:

$ interest income from a loan to its percent owned US subsidiary.

$ dividend income from its percent owned German subsidiary.

$ royalty income from its French subsidiary for use of a trademark within the United States.

$ rent income from its Dutch subsidiary for use of a warehouse located in Belgium.

$ capital gain from sale of stock in its percent owned Mexican joint venture. Title passed in the United States.

What amount of foreign source income does Plum have?

B Ava transferred $ million of real estate into an irrevocable trust for her son, Luis. The trustee was directed to retain income until Luis' st birthday and then pay him the corpus of the trust. Ava retained the power to require the trustee to pay income to Luis at any time and retained the right to the assets if Luis predeceased her. What amount of the trust, if any, will be included in Ava's estate if she died shortly after making the transfer?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock