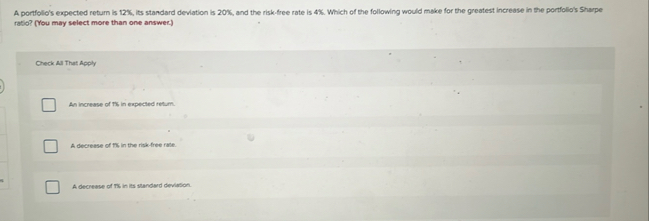

Question: A porffolo's expected return is 1 2 % , its standard deviation is 2 0 % , and the risk - free rate is 4

A porffolo's expected return is its standard deviation is and the riskfree rate is Which of the following would make for the greatest increase in the portfolio's harpe ratio? You may select more than one answer

Check al That Apply

An increase of in expected retum.

A decresse of thi in the riak free rake.

A decrease of thi in is standerd deviation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock