Question: A portable concrete test instrument used in construction for evaluating and profiling concrete surfaces (MACRS-GDS 5-year property class) is under consideration by a construction form

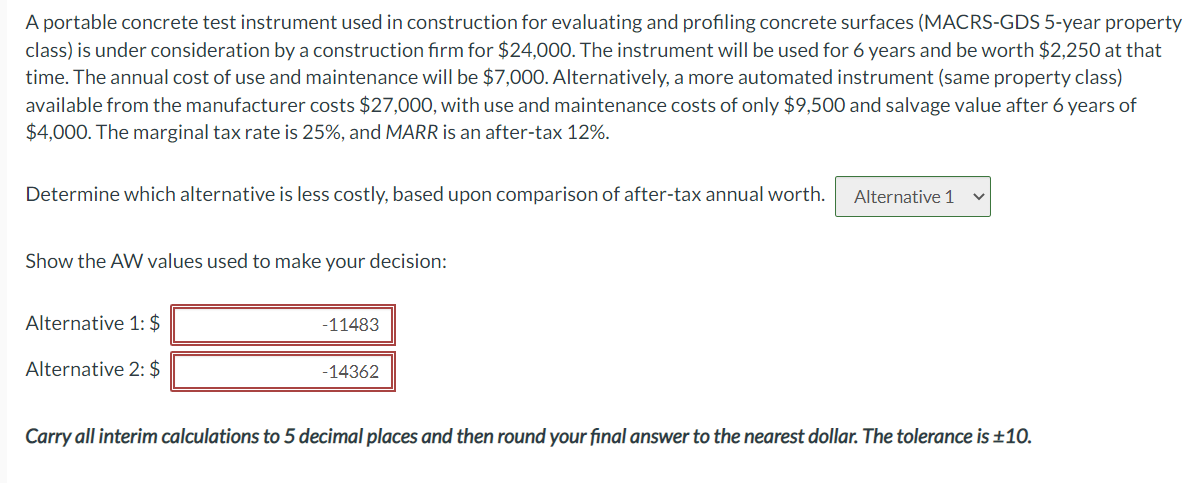

A portable concrete test instrument used in construction for evaluating and profiling concrete surfaces (MACRS-GDS 5-year property class) is under consideration by a construction form for $24,000. The instrument will be used for 6 years and be worth $2,250 at that time. The annual cost of use and maintenance will be $7,000. Alternatively, a more automated instrument (same property class) available from the manufacturer costs $27,000, with use and maintenance costs of only $9,500 and salvage value after 6 years of $4,000. The marginal tax rate is 25%, and MARR is an after-tax 12%. Determine which alternative is less costly, based upon comparison of after-tax annual worth. Alternative 1 Show the AW values used to make your decision: Alternative 1: $ - 11483 Alternative 2: $ - 14362 Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is +10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts