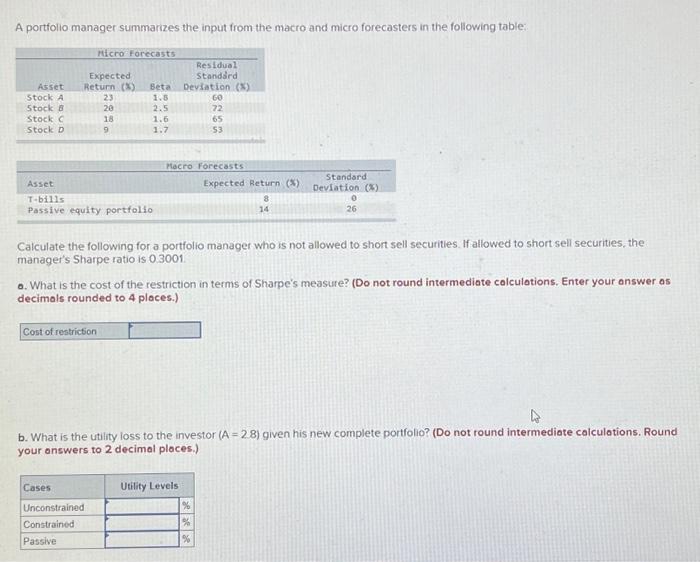

Question: A portfolio manager summarizes the input from the macro and micro forecasters in the following table: Caiculate the following for a portfolio manager who is

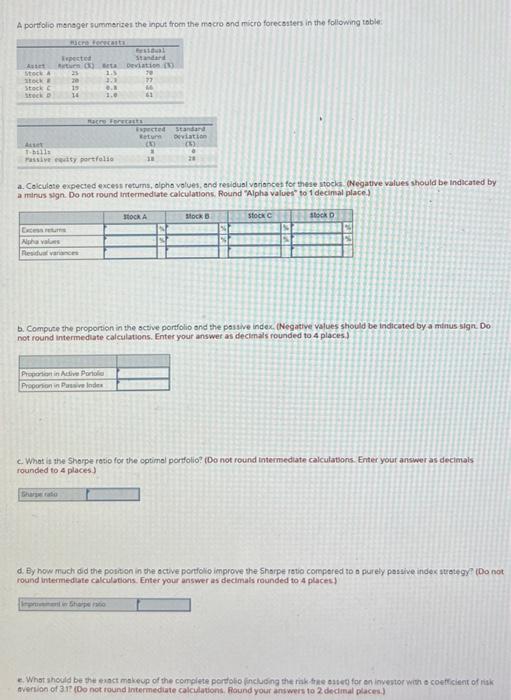

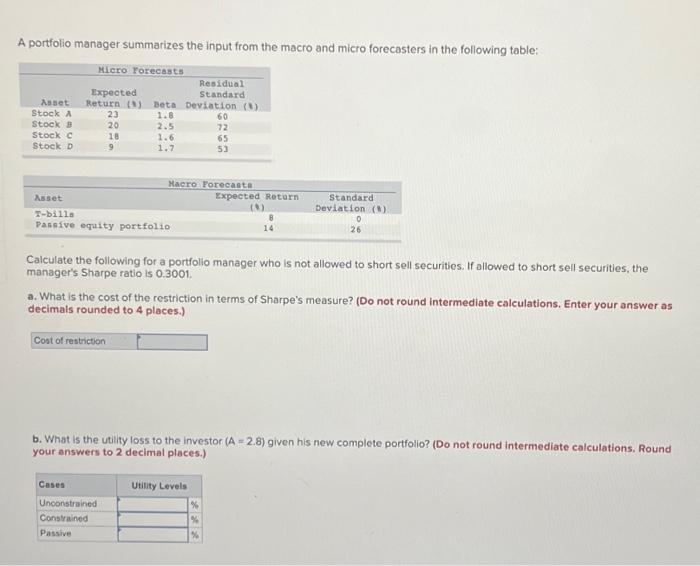

A portfolio manager summarizes the input from the macro and micro forecasters in the following table: Caiculate the following for a portfolio manager who is not allowed to short sell securities. If allowed to short sell securities, the manage's Sharpe ratio is 0.3001 o. What is the cost of the restriction in terms of Sharpe's measure? (Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) b. What is the utility loss to the investor (A=28) given his new complete portfolio? (Do not round intermediate colculations. Round your onswers to 2 decimal places.) A porttolio maneger summerites the input from the macro snd micro forecsstens in the following toble: a. Colculose expected excess retums, olpho volues, end residual voriances for these itocka. (Negative values should be indicated by a marus stgn. Do not round intermedute calculations. Round "Alpha values" to 1 decinal place. b. Compuce the proporion in the sctive porfolio ond the psisve index. (Negative values should be indicated by a mitius sign Do not round intermediate calculations. Enter your answer as decinals rounded to 4 places: c. What it the Shorpe rotio for the cotimal portfolio? (Do not round intermediate calculatons. Enter your answer as decimals rounded to 4 places) d. Ey how much did the peston in che active pertilil improve the Shorpe retio compored to a purely postre index atretegy? (Do not round intermedate calculabons. Enter your answer as decimals rounded to 4 places) E. Whot aheuld be the einct makeup of the complete pertolo finclueing the rikk the ersed for en invevtor with a coefficient of ritk Averian of 31 i (Do not round intermediate calculations. Round your answers to 2 decisal places.) A portfolio manager summarizes the input from the macro and micro forecasters in the following table: Calculate the following for a portfolio manager who is not allowed to short sell securities. If allowed to short sell securities, the manager's Sharpe ratio is 0.3001 . a. What is the cost of the restriction in terms of Sharpe's measure? (Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) b. What is the utility loss to the investor (A=2.8) given his new complete portfolio? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts