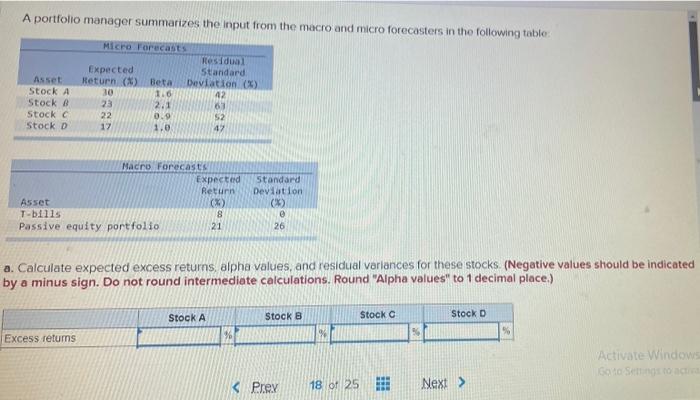

Question: A portfolio manager summarizes the input from the macro and micro forecasters in the following table Asset Stock A Stock B Stock C Stock D

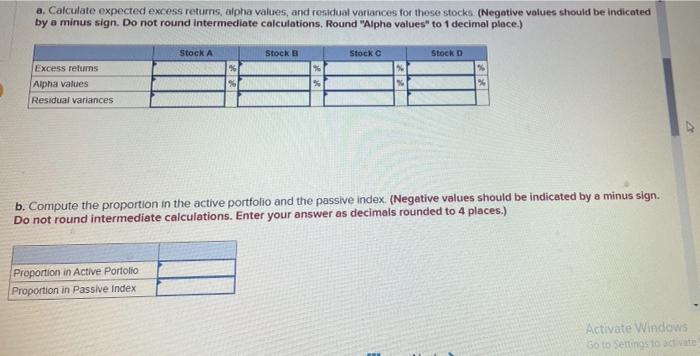

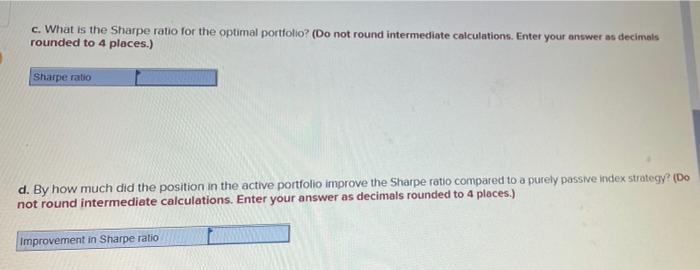

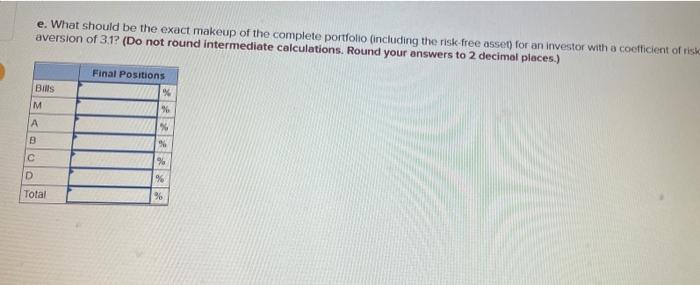

A portfolio manager summarizes the input from the macro and micro forecasters in the following table Asset Stock A Stock B Stock C Stock D Micro Forecasts Residual Expected Standard Return Beta Deviation) 30 1.6 42 23 2.1 63 22 0.9 52 17 1.0 42 Macro Forecasts Expected Return Asset (%) T-bills 8 Passive equity portfolio 21 Standard Deviation (*) e 26 a. Calculate expected excess returns, alpha values, and residual variances for these stocks (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round "Alpha values" to 1 decimal place.) Stock A Stock B Stock Stock D 9 Excess returns Activate Windows Sono Sesto a. Calculate expected excess returns, alpha values, and residual variances for those stocks. (Negotive values should be indicated by a minus sign. Do not round Intermediate calculations. Round "Alphe values" to 1 decimal place.) Stock A Stocks Stock Stock Excess returns Alpha values Residual variances % b. Compute the proportion in the active portfolio and the passive index (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) Proportion in Active Portolio Proportion in Passive Index Activate Windows Go to Settings to date c. What is the Sharpe ratio for the optimal portfolio? (Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) Sharpe ratio d. By how much did the position in the active portfolio improve the Sharpe ratio compared to a purely passive index strategy? (Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) Improvement in Sharpe ratio e. What should be the exact makeup of the complete portfolio (including the risk-free asset) for an investor with a coefficient of risk aversion of 3.1? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Final Positions % Bills M % A % % % ID Total A portfolio manager summarizes the input from the macro and micro forecasters in the following table Asset Stock A Stock B Stock C Stock D Micro Forecasts Residual Expected Standard Return Beta Deviation) 30 1.6 42 23 2.1 63 22 0.9 52 17 1.0 42 Macro Forecasts Expected Return Asset (%) T-bills 8 Passive equity portfolio 21 Standard Deviation (*) e 26 a. Calculate expected excess returns, alpha values, and residual variances for these stocks (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round "Alpha values" to 1 decimal place.) Stock A Stock B Stock Stock D 9 Excess returns Activate Windows Sono Sesto a. Calculate expected excess returns, alpha values, and residual variances for those stocks. (Negotive values should be indicated by a minus sign. Do not round Intermediate calculations. Round "Alphe values" to 1 decimal place.) Stock A Stocks Stock Stock Excess returns Alpha values Residual variances % b. Compute the proportion in the active portfolio and the passive index (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) Proportion in Active Portolio Proportion in Passive Index Activate Windows Go to Settings to date c. What is the Sharpe ratio for the optimal portfolio? (Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) Sharpe ratio d. By how much did the position in the active portfolio improve the Sharpe ratio compared to a purely passive index strategy? (Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) Improvement in Sharpe ratio e. What should be the exact makeup of the complete portfolio (including the risk-free asset) for an investor with a coefficient of risk aversion of 3.1? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Final Positions % Bills M % A % % % ID Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts